Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

C.D. Howe study urges Ottawa to drop mandatory withdrawals

Article content

Article content

Good morning,

Advertisement 2

Story continues below

Article content

Canadians are living longer and earning less on their investments, but Ottawa’s rules for Registered Retirement Income Funds (RRIFs) are “stuck in the past,” says a report from the C.D. Howe Institute.

William Robson and Alexandre Laurin argue that current age limits and mandatory withdrawals on RRIFs mean that more seniors will have “negligible income from their tax-deferred saving in their later years.”

“Government impatience for revenue should not force holders of RRIFs and similar tax-deferred vehicles to deplete their nest eggs prematurely,” wrote the authors.

Under the RRIF regime, which started in 1978, Canadians must convert their Registered Retirement Savings Plans, which defer taxes, into Registered Retirement Income Funds by the end of the year that they turn 71. Starting at 72, they must withdraw a certain percentage of that amount each year, which is taxed.

Article content

Advertisement 3

Story continues below

Article content

The formula has been updated several times over the years and the government temporarily reduced mandatory withdrawals twice, in response to the 2008 financial crisis and during the COVID-19 pandemic, but these short-term fixes just highlighted a chronic problem, said the report.

The problem is people are living longer yet the age at which they must stop contributing to their defined contribution pension plan or RRSPs and start making withdrawals has not kept up.

Investment returns on Canadian government bonds have also fallen to 0.65 per cent, compared to returns near six per cent in years past.

The study estimates that the purchasing power of RRIF withdrawals could decline by almost half of their initial value by the time the holder reaches 94.

Advertisement 4

Story continues below

Article content

“Nowadays, about one in eight men age 71 and one in five women age 71 can expect to reach age 94 — and of course, those who live past that age see the purchasing power of their withdrawals drop precipitously,” said the authors.

The most straightforward solution would be to eliminate mandatory withdrawals altogether, says the study.

Though this would delay tax revenue and clawbacks from other benefits for the government, the fiscal impact would likely be small, it said.

“For RRIF holders, by contrast, full elimination would remove complexity in financial planning, and full or partial elimination would alleviate a threat to income security in retirement,” said the authors.

At the minimum, ages at which saving must stop and withdrawals start and accelerate should be higher to reflect current realities, they said. The study recommends raising these ages by three years.

Advertisement 5

Story continues below

Article content

The C.D. Howe Institute authors join other calls for RRIF reform from both industry and politicians. Earlier this year the Department of Finance started a study on whether the framework continues to be appropriate after a private member’s bill. It is due to report its findings in June.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

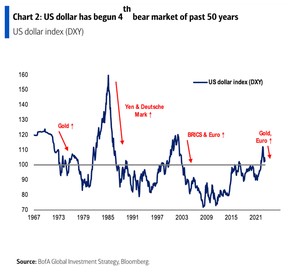

The U.S. dollar is entering its fourth bear market in 50 years, predicts Michael Hartnett, chief investment strategist at Bank of America, who brings us today’s chart. In the latest edition of the Flow Show, Hartnett and his team forecast a 20 per cent decline in the U.S. dollar index (DXY). The currency hit a two-month low last week after five straight weeks of losses, but has since gained back some ground as markets bet on more Federal Reserve hikes.

Advertisement 6

Story continues below

Article content

Hartnett’s six reasons for dollar “heebie-jeebies” are: a growing U.S. federal deficit; the approach of the U.S. debt ceiling; rising debt default probabilities; banking crisis diminishes dollar’s status as a safe haven; “petroyuan” argument gains steam as the war has been forcing countries to conduct deals in alternate currencies and China and Japan are cutting Treasury holdings.

Meanwhile, he is bullish on gold, oil, the euro and international stocks. “We remain “patient bears” (in a world of impatient bears),” he wrote.

- Office of the Superintendent of Financial Institutions releases its annual risk outlook for 2023-2024

- Yves Giroux, parliamentary budget officer, Tiff Macklem, governor of the Bank of Canada and deputy Carolyn Rogers appear before the standing committee on finance regarding the national economic and fiscal outlook

- Bank of Montreal holds its annual meeting of shareholders

- Today’s Data: Look for a big drop in the annual inflation rate when the March consumer price index comes out today. RBC economists see the annual rate falling to 4.2 per cent, a full percentage point lower than in February. Does that mean interest rates will soon follow inflation lower? It’s not that simple. Stephanie Hughes has what you need to know. Also on deck, U.S. housing starts & building permits

- Earnings: Bank of America, Goldman Sachs, Bank of New York Mellon, Johnson & Johnson, Netflix, United Airlines, Equifax Inc.

Advertisement 7

Story continues below

Article content

___________________________________________________

_______________________________________________________

The rise of generative artificial intelligence and its potential economic impacts have been all over the headlines lately. Economists David Rosenberg and Julia Wendling say productivity will undoubtedly receive a boost, but the displacement among many white-collar jobs is likely to be a painful casualty, meaning AI will be disinflationary just like the internet was. Find out more

-

Should we use the money in our TFSAs to pay off our mortgage?

-

Grieving is hard enough already; banks shouldn’t make it harder

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation