Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

We’re back in a sellers’ market for the first time since April 2022

Article content

Article content

Good Morning!

Advertisement 2

Story continues below

Article content

The year-long winter may be coming to a close in Canada’s housing market, with many economists calling an end or near end to the correction that has seen home sales and prices plummet off pandemic highs.

Home sales rose 1.4 per cent in March, following a 1.5 per cent advance in February, the first back-to-back monthly gains since the correction began 12 months ago.

But while buyers are returning, there is still something missing — sellers.

“A complete lack of new listings is the big story now,” writes BMO senior economist Robert Kavcic.

New listings, down 5.8 per cent nationally in March, were the lowest for the month in 20 years, said Kavcic, and back then the population was 20 per cent or 8 million people smaller.

Economists say the Bank of Canada‘s pause in rate hikes has emboldened buyers back to the market, so why not sellers?

Advertisement 3

Story continues below

Article content

Kavcic says in the past, housing downturns that have evolved from a price correction into a crash — like the housing crisis in the United States in 2008 or southern Ontario in the 1990s — have been driven by forced selling.

That isn’t happening this time, and there are several reasons why, he said.

Potential sellers don’t want to sell in a downmarket and this time they don’t have to, thanks to a strong job market and limited mortgage delinquencies.

Banks are giving homeowners on variable-rate mortgages a buffer by stretching out amortizations instead of hiking payments as rates have risen from below 2 per cent to above 6 per cent during the Bank of Canada’s aggressive rate hiking cycle over the past year.

The Office of the Superintendent of Financial Institutions made sure most buyers were stress tested. Even those who took out mortgages at 1.5 per cent had to prove they could handle rates in the 4.75 per cent to 5.25 per cent range or higher.

Article content

Advertisement 4

Story continues below

Article content

A strong rental market is making it worthwhile for investors to hang in there, even as cash flow worsens. “Swallow a capital loss or hang on? Many seem to be hanging on,” said Kavcic.

Add to all that a surge in population from immigration and you have a very tight housing market.

The national sales-to-new-listing ratio hit 63.5 per cent in March, up more than 10 percentage points in two months, returning Canada’s housing market to seller’s territory for the first time since April 2022. There were 3.9 months of inventory on the market, down from the pre-pandemic norm of five months.

The lack of sellers is also putting a floor under home prices, said Kavcic. The national composite MLS Home Price Index rose 0.2 per cent in March, the first gain in over a year.

Advertisement 5

Story continues below

Article content

Ontario markets led the gains, with prices rising 3.1 per cent from the month before in Sudbury, 1.6 per cent in Toronto and 1 per cent in Kitchener-Waterloo.

Vancouver home prices were flat but some markets saw declines, including Calgary, down 0.2 per cent, Ottawa, down 0.7 per cent, Montreal down 0.3 per cent and St. John’s, off 1.4 per cent.

“Prices are still down 15.5 per cent from a year ago and 16 per cent from peak levels, but that could be it for this correction,” said Kavcic.

What happens next depends on the economy.

“Reaching the cyclical bottom doesn’t mean activity and prices are about to rebound sharply immediately thereafter, wrote RBC assistant chief economist Robert Hogue in a note.

RBC sees the recovery starting slowly later this year as affordability and a slower economy hold buyers back.

Advertisement 6

Story continues below

Article content

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

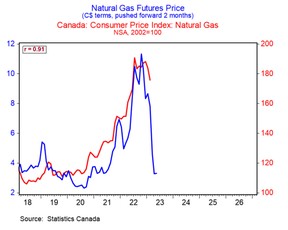

Just in time for BBQ season, Canadians are going to get some relief on natural gas prices, says BMO economist Benjamin Reitzes, who brings us today’s chart.

Prices have plunged back to earth after a surge over the past two years because Europe didn’t suffer the shortages everyone feared. Reitzes said prices could fall 30 per cent or more depending on the jurisdiction, though this likely won’t show up until the April consumer price report.

Natural gas isn’t a huge portion of the CPI basket, just 0.78 per cent, the economist said, but it’s enough to trim 0.2 percentage points from headline inflation.

Advertisement 7

Story continues below

Article content

“There’s a bit of a lag between market prices and what consumers pay, but have no fear, price relief is here,” said Reitzes.

- The Public Service Alliance of Canada will hold a press conference to provide an update on the status of negotiations with Treasury Board and Canada Revenue Agency on behalf of more than 155,000 federal government workers

- Today’s Data: Canada’s wholesale trade, international securities transactions and new motor vehicle sales

- Earnings: Parkland Corp., Charles Schwab, PrairieSky Royalty

___________________________________________________

_______________________________________________________

Advertisement 8

Story continues below

Article content

Rising interest rates are a common concern for many fixed-rate borrowers whose mortgages are coming due, leaving them wondering whether they should pay off as much as possible rather than renew. Certified financial planner Daniel Perras says higher borrowing costs makes using your savings to pay off your mortgage quite attractive, but there are several things to consider since you’re essentially turning liquid money into illiquid home equity. FP Answers has the answers.

-

Home sales up in March as buyers re-enter market

-

How house hunting in Montreal compares to New Zealand

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation