Article content

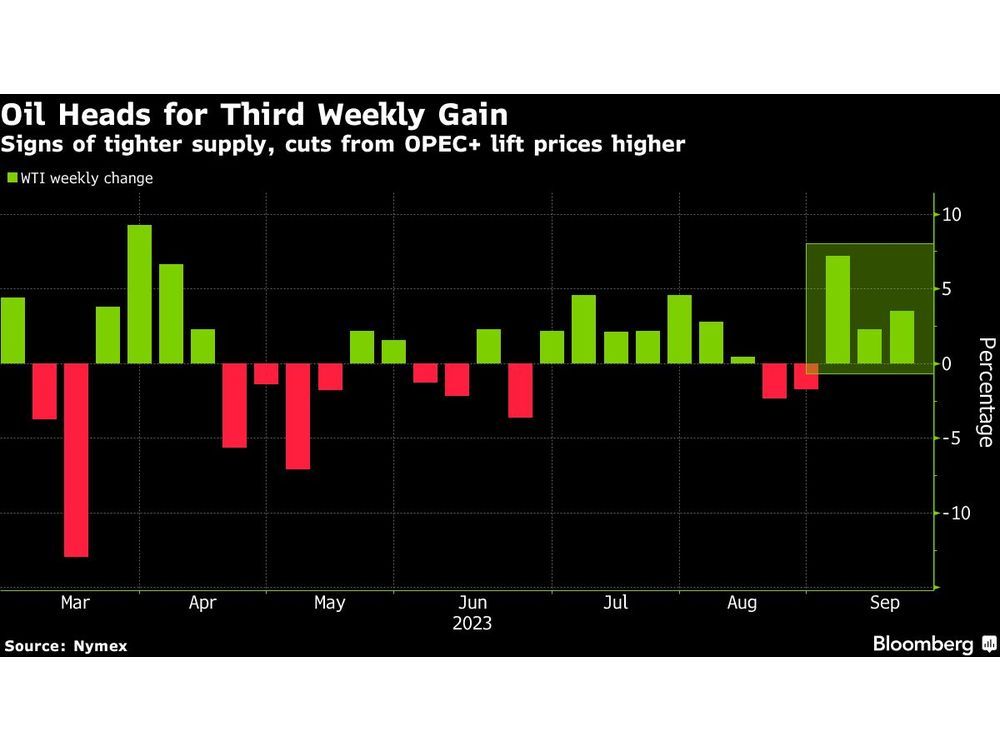

(Bloomberg) — Oil headed for a third weekly gain as the market continued to tighten on the back of supply curbs from Saudi Arabia and Russia.

West Texas Intermediate advanced on Friday after crossing the $90 a barrel mark for the first time since November on Thursday. The International Energy Agency and Organization of Petroleum Exporting Countries both warned this week that the market would be in deficit through the end of the year, helping to propel crude to a gain of almost 4% since last Friday’s close.

Article content

Demand has also held up on increasing signs the US may be able to avoid a recession, while consumption in China has been resilient despite an economic downturn there. The tightening market is also being reflected in surging fuel prices, with diesel at a record high on a seasonal basis in New York.

The US crude benchmark has now surged 35% from a low in mid-June, with predictions from analysts that oil will reach $100 a barrel becoming less rare. Still, there are technical signs that the rally is overdone. WTI’s 14-day relative strength index has been above a threshold that signals a pullback is possible for much of the past two weeks.

“Oil markets now have to consider whether $100 a barrel is a possibility for Brent futures in the second half of 2023 given the extent of OPEC+ supply cuts,” said Vivek Dhar, director of mining and energy commodities research at Commonwealth Bank of Australia. Lower global crude stockpiles are putting prices at risk of increased volatility, he said.

Widely-watched timespreads continue to signal a supply shortfall. The gap between global benchmark Brent’s two nearest contracts is 80 cents a barrel in bullish backwardation, the highest level since November.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.