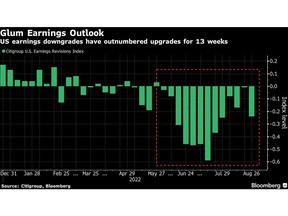

One of Wall Street’s biggest bears is turning even more pessimistic on the outlook for US earnings against the backdrop of a slowdown in economic growth.

Article content

(Bloomberg) — One of Wall Street’s biggest bears is turning even more pessimistic on the outlook for US earnings against the backdrop of a slowdown in economic growth.

Article content

Morgan Stanley strategist Michael J. Wilson cut his expectations for earnings-per-share growth for the year, saying that a slowing economy is now likely to be a bigger concern for stocks, rather than scorching inflation and a hawkish Federal Reserve. In 2023, he expects earnings to fall 3% even in the absence of a recession.

Article content

“We think the next several quarters will end up containing some of the most significant downward revisions to forward EPS forecasts we have seen in the past several cycles,” Wilson wrote in a note on Tuesday.

The strategist, who correctly predicted the slump in US stocks this year, expects equities to plumb new lows as investor optimism about a stronger-than-expected second-quarter earnings season fades. The S&P 500 has already given up about half its gains since a June low as the Fed indicated it will stick to rate hikes to tame inflation.

Article content

Wilson expects the “lows for this bear market will likely arrive in the fourth quarter.” He sees the S&P 500 falling to at least 3,400 points — about 13% below current levels — and to as low as 3,000 in the event of a recession.

Morgan Stanley’s European strategists also expect regional corporate margins to come under pressure from a worsening energy crisis and hawkish central banks, they said on Monday. JPMorgan Chase & Co. strategists, on the other hand, anticipate peaking inflation will help support stocks through the rest of the year. Global earnings are also expected to hold up “much better this time around than during past downturns,” strategist Mislav Matejka wrote in a note yesterday.