Article content

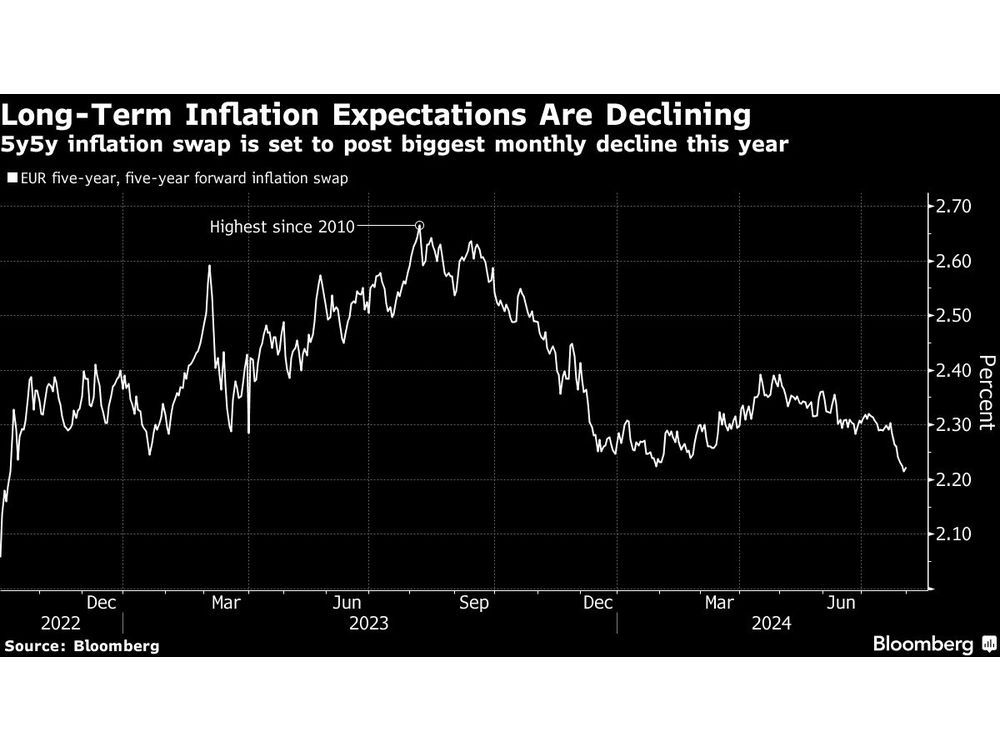

(Bloomberg) — A market gauge of future euro-area inflation posted its biggest monthly drop this year, a sign investors are increasingly confident price growth will stay tame for the long term.

The so-called five-year, five-year forward inflation swap rate — a proxy for inflation expectations in the second half of the coming ten years — fell 10 basis points last month. It points to an average inflation rate of 2.20% in the period, the slowest pace in more than 18 months and well below a 2.67% peak seen last August when gas prices were jumping.

Article content

The move suggests investors are confident that the European Central Banks can keep prices in check over the long term, even after data Wednesday showed consumer prices unexpectedly quickened in July. The inflation-linked swaps are important because policymakers watch them closely for signs the market is worried they could lose control over prices.

“There is a consensus forming around ECB being the master of inflation again,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management. “Both short-term and long-term inflation expectations in the market should remain well-anchored,” he added.

That appears to be the case, with the one-year forward inflation swap rate this week closing below 2% — the ECB’s target — for the first time since early February. It’s declined sharply from a recent peak of 2.27% in mid June.

Inflation around the world surged during the pandemic, imposing heavy losses on investors of all stripes and forcing central banks to hike interest rates aggressively. In the euro area, Russia’s 2022 invasion of Ukraine triggered an energy crisis that exacerbated price pressures and sent inflation to a record high of 10.6%.

Article content

Euro-Zone Inflation Sees Surprise Uptick in Headache for ECB

It’s since fallen to 2.6%, according to data released Wednesday. While that’s marginally higher than forecast, money markets continue to price a higher chance of a second quarter-point rate cut in September and nearly 60 basis points of further easing through 2024.

What Bloomberg Economics Says…

“Our Nowcast model (which provides a judgment-free prediction) flags a decline to 2.2% in August for headline inflation. Our forecast is for a drop to 2.1% in August on base effects from energy and September should see a dip below the 2% target.”

— David Powell, senior economist. Read the full note here.

Against that backdrop, bond yields have fallen to their lowest levels in months. The 10-year yield touched 2.31% on Wednesday, its lowest level since March, while the two-year yield — among the most sensitive to monetary policy — is around the lowest since February.

“The balance of risks between growth and inflation is becoming more finely balanced, with recent data suggesting the European economy is losing some steam,” said Matthew Landon, global market strategist at J.P. Morgan Private Bank.

Share this article in your social network