Article content

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Story continues below

The euro is languishing below parity with the dollar after its latest selloff, and there’s little hope that even a hefty hike in interest rates would rescue it.

Rather than monetary policy, it’s the interlinked threats of a recession and a Russian energy cutoff that are weighing down the common currency, according to analysts. Those dynamics are hard for the European Central Bank to counter — even if it deploys the kind of outsized moves in borrowing costs enacted recently by the Federal Reserve.

“Rates haven’t been in the driver’s seat in FX markets, particularly in the past month — it’s really about global growth dynamics,” said Sam Zief, head of global FX strategy at JPMorgan Private Bank. “Big rate hikes aren’t currency supportive when they’re being done to keep inflation expectations anchored and hurting the growth outlook at the same time.”

Story continues below

Faced with the fastest inflation since the euro was introduced, the ECB raised borrowing costs for the first time in more than a decade last month, lifting its deposit rate by a half-point to 0%.

While investors expect another move of that size on Sept. 8, storm clouds are converging over the euro zone’s 19-nation economy as the cost-of-living crisis and Russia’s invasion of Ukraine squeeze households and companies.

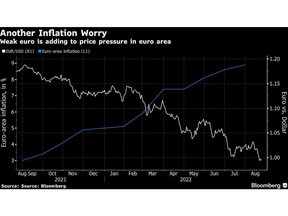

Business surveys released Tuesday by S&P Global showed activity shrinking for a second month, with the pandemic rebound in areas like tourism almost grinding to a halt. Meanwhile the weak euro, which hit a two-decade low against the dollar this week, is strengthening inflation by making imports more expensive — a particular concern when much of the region’s inflation is driven by energy that’s largely priced in dollars.

Story continues below

The gloomy backdrop means that even an unprecedented three-quarter-point rate hike wouldn’t boost the euro meaningfully, according to Dirk Schumacher, an economist at Natixis in Frankfurt.

“Choosing 75 basis points over 50 wouldn’t change much,” he said. “You need a minimum of a positive economic outlook to significantly influence the exchange rate with interest-rate moves alone.”

ECB Jumbo Hike Coming as Winter Arrives for Euro: Trader Talk

Asked whether a larger hike would make sense in the context of the falling euro, Joerg Kraemer, chief economist at Commerzbank AG, said such a step “would probably be a good idea given the inflation outlook.” While he doesn’t exclude that outcome, he said he doesn’t “believe the ECB will go for it.”

Story continues below

Indeed, ECB Executive Board member Fabio Panetta on Tuesday urged prudence in plotting next steps as the prospect of a downturn in the euro area becomes ever-more likely.

“If we will have a significant slowdown or even a recession, this would mitigate inflationary pressures,” he told a panel discussion in Milan.

His colleague Isabel Schnabel, however, has acknowledged the negative impact the weak currency is having on the inflation outlook, telling Reuters that it matters even more when the economy faces an energy-price shock.

Money markets have priced in a half-point increase next month and placed 20% odds on 75 basis points. Beyond that, traders are betting on 130 basis points of tightening by year-end, with the deposit rate eventually rising to 2% by September 2023.

Story continues below

Germany, Europe’s largest economy, is a particular weak spot as the government struggles to replace natural gas imports from Russia and rising prices threaten the country’s crucial manufacturing sector.

Issues like that will probably tilt policy makers toward another 50 basis-point move, according to Marco Valli, chief European economist at UniCredit.

“The ECB will go for a half-point hike in September — more would be a big surprise and actually a mistake,” he said. “The exchange rate reflects to a large extent the problems the euro zone is facing right now. It’s not something the ECB needs to chase.”

Story continues below