Article content

(Bloomberg) — European stocks were little changed by the close, recouping the day’s decline as investors weighed the outlook for inflation and US interest rates.

The Stoxx Europe 600 Index was little changed by the close, as data showed US inflation matched estimates last month. Traders increased wagers on a December rate cut from the Federal Reserve following the report, according to swaps data.

Article content

Still, investors remain on edge about any possible flare-up in inflation in the wake of president-elect Donald Trump’s pro-growth policies.

“A hotter-than-expected inflation number could have convinced the Fed to stand pat at its next meeting so the in-line number can almost be considered as a beat,” said Seema Shah, chief global strategist at Principal Asset Management. “The rising likelihood is that, come early 2025, rather than reducing policy rates at each meeting, the Fed is likely to slow its cutting pace to every other meeting.”

Siemens Energy AG bucked the broader trend to rally 19% after raising its mid-term targets, while power generator RWE AG rose 6% after saying it would buy back as much as €1.5 billion ($1.6 billion) of shares.

The auto, technology and real estate sectors underperformed Wednesday, while energy, consumer products and insurance stocks advanced.

Europe’s benchmark index has fallen since Trump won the election last week as his America-first policies are widely expected to hurt markets outside the US, while reigniting inflation. Direct or indirect tariffs would also weigh on corporate earnings.

Article content

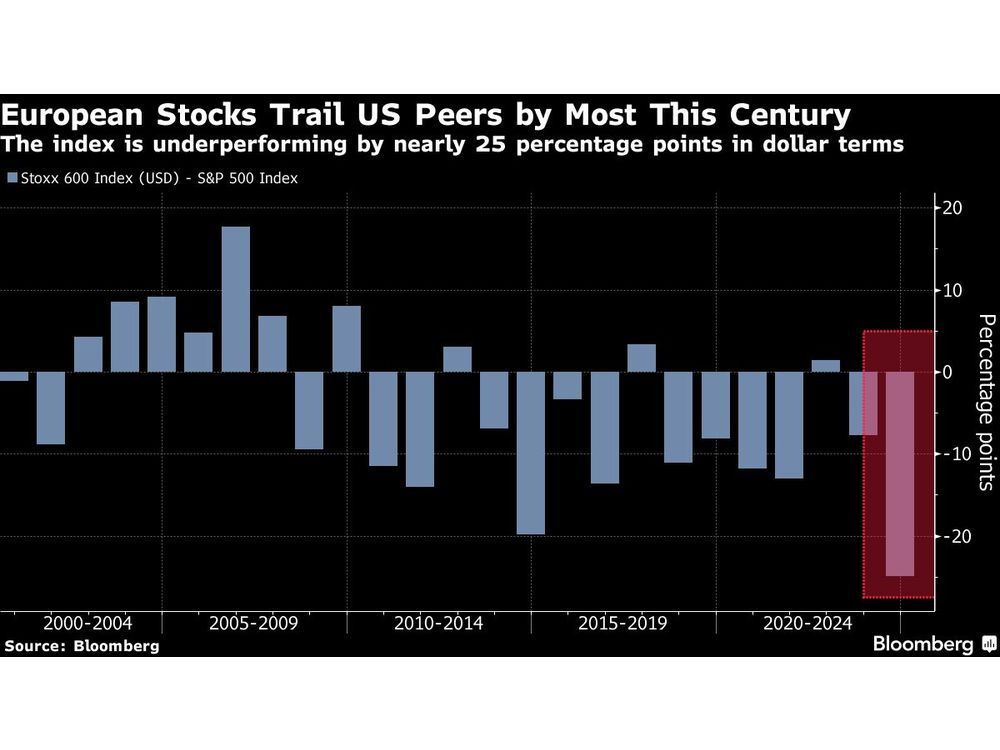

The Stoxx 600 is trailing the S&P 500 this year by the most in at least 24 years in dollar terms, and some investors expect the gap to remain wide.

“We expect higher risk premia to persist in the tariff-exposed segments until greater clarity emerges,” said Mathieu Racheter, head of equity strategy at Julius Baer. “We maintain our cautious stance toward European equities, opting to remain on the sidelines for the time being.”

Among other notable movers, Just Eat Takeaway.com NV surged 16% as it is selling restaurant delivery service Grubhub to Wonder Group Inc.

With the earnings season drawing to a close, Barclays Plc strategists warned companies remain cautious about the economic outlook.

For more on equity markets:

- Complacency Is on the Rise in This Equity Rally: Taking Stock

- M&A Watch Europe: Just Eat Takeaway, BBVA, Sabadell, VW, RWE

- Dual Listings Are ‘Going Out of Fashion’ in Europe: ECM Watch

- US Stock Futures Little Changed; Spirit Air, Groupon Fall

- Astra’s Triple Shot: The London Rush (Correct)

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

Share this article in your social network