Article content

(Bloomberg) — The European Central Bank is on track to start cutting interest rates next month, but will need to keep policy in restrictive territory through 2024, according to Chief Economist Philip Lane.

“The best way to frame the debate this year is that we still need to be restrictive all year long,” Lane told the Financial Times in an interview published Monday. “But within the zone of restrictiveness we can move down somewhat.”

Article content

Asked about the prospect of a move at the June 6 meeting, he said that “barring major surprises, at this point in time there is enough in what we see to remove the top level of restriction.”

A start on monetary easing at the next ECB meeting has been widely telegraphed. Subsequent steps are less clear, with markets expecting policymakers to sit out July and resume reductions in September. That pause would chime with comments from hawkish officials Joachim Nagel and Isabel Schnabel, though most Governing Council members have stayed mute on the topic.

“Next year, with inflation visibly approaching the target, then making sure the interest rate comes down to a level consistent with that target — that will be a different debate,” Lane said.

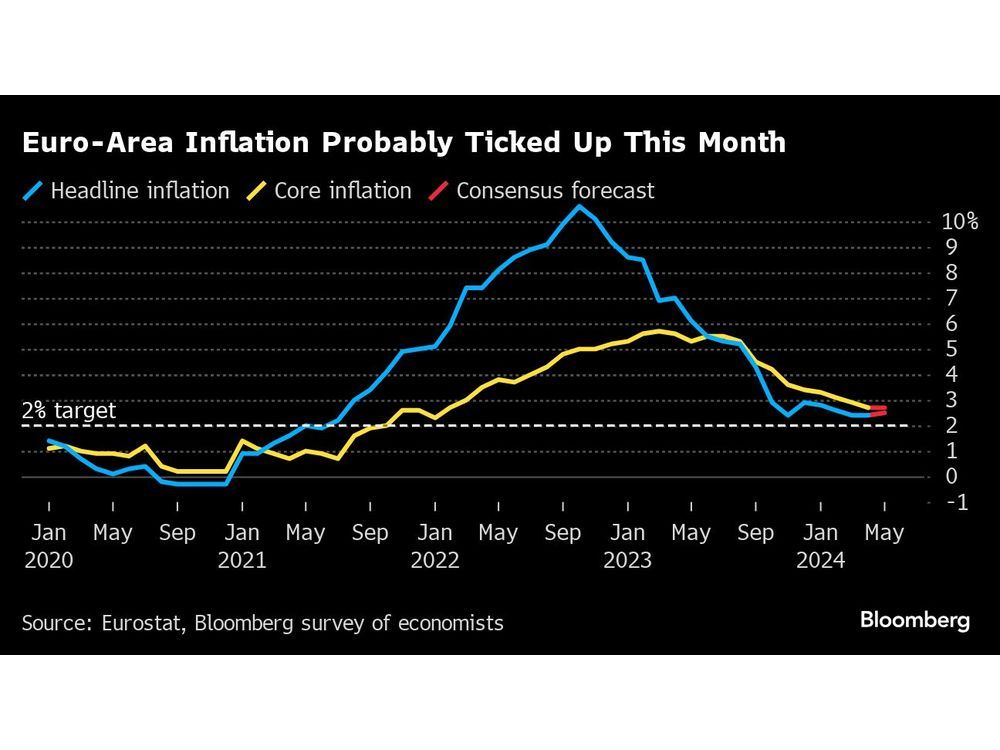

Next months rates move comes against a backdrop of inflation that potentially ticked up in May. Additionally, the so-called core measure that policymakers tend to focus on — because it strips out volatile elements such as energy — probably stopped weakening for the first time since July.

Additionally, a key wage indicator published last week also accelerated in the first quarter, though Lane said that “the overall direction of wages still points to deceleration, which is essential.”

“Things will be bumpy and things will be gradual,” the ECB chief economist said.

Share this article in your social network