Article content

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Article content

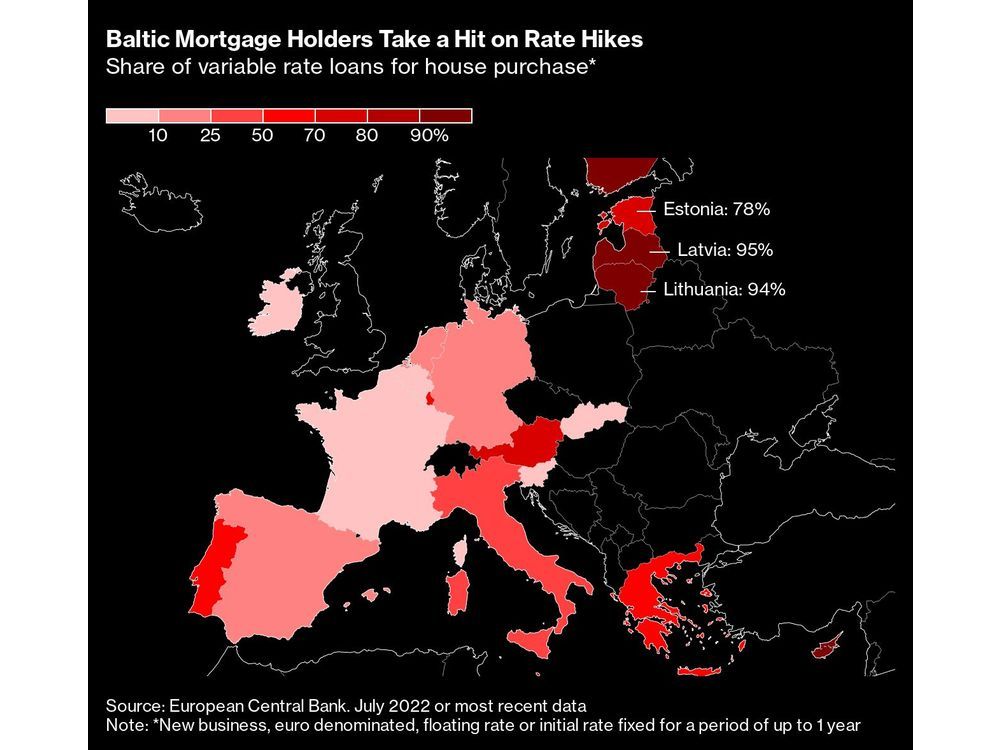

Already enduring the euro zone’s steepest inflation, the Baltic region is now finding it’s the most exposed part of the bloc to rising interest rates.

Article content

Estonia, Latvia and Lithuania have all seen consumer-price gains surge beyond 20%, with their officials at the European Central Bank pushing hard for aggressive rises in borrowing costs.

But with a 75 basis-point hike arriving this month following July’s opening salvo of a half point, another problem has emerged: nine in 10 Baltic mortgage holders are locked into variable-rate loans whose costs have immediately jumped.

The shift couldn’t come at a much worse time. Eye-watering inflation — which topped 25% last month in Estonia — coupled with a slowing global economy and soaring energy costs heading into the winter are tilting the region toward a recession.

Article content

“This is going to affect existing loans to a much higher extent than other places in the European Union,” said Martins Abolins, an economist at Citadele Banka in Riga. “Everything is coming together for this winter.”

The hit is sizable. Home and business loans adjust in lockstep with interbank rates, with six-month euribor up about 160 basis points since June — equivalent to 75 euros ($74.87) more a month on a typical 100,000 euro mortgage, according to Rasmus Kattai, an economist at the Bank of Estonia.

With net monthly salaries averaging 1,350 euros in Estonia and more rate increases in the pipeline, that will come as a jolt to borrowers who’d grown used to ultra-cheap loans stemming from an ECB deposit rate that remained stuck below zero for eight years.

Article content

Their plight underscores a drawback of euro membership for some of the bloc’s smaller nations. While inflation has surged across the 19-member currency union, it took off earlier in the Baltic countries and rocketed well before the ECB lifted rates.

For now, the Baltics — unwilling former Soviet republics that still remember being ruled from Moscow — accept that the higher costs they face are a justified consequence of assisting Ukraine in defending itself from Russian aggression.

The energy spike represents “a war tax that we have to pay,” Latvian Prime Minister Krisjanis Karins said this week. Ukraine is paying “with lives and, for us, money.”

But the costs will increasingly be felt — despite government aid and the best efforts of officials to put a brave face on the situation.

Lithuanian central bank chief Gediminas Simkus hopes higher rates will help ease excessive advances in real-estate prices. For average borrowers, who have an outstanding mortgage balance of 50,000 euros over 20 years, a 1.5 percentage-point increase in euribor would lift payments by 38 euros a month.

“I leave this up to you” how significant a rise that is, Simkus said.

Read more:

- ECB Needs ‘Resolute’ Hike of at Least a Half-Point, Kazaks Says

- Euro-Zone Inflation Is Diverging by an Unprecedented Amount

- Runaway Inflation Flashes Recession Warning on Euro Zone’s Edge