Article content

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The European Central Bank delivered an unprecedented three-quarter-point interest-rate hike this week, and another steep adjustment next month remains a distinct possibility in an escalating assault on rampant inflation.

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Story continues below

The European Central Bank delivered an unprecedented three-quarter-point interest-rate hike this week, and another steep adjustment next month remains a distinct possibility in an escalating assault on rampant inflation.

Newly appointed UK Prime Minister Liz Truss laid out plans to rescue an economy in its worse state since the 1970s. On Thursday, Britons were shaken by news of the passing of Queen Elizabeth II.

In Asia, China’s economy showed more signs of weakening as export growth slowed, while Japanese households cut back on spending.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Europe

The ECB hiked interest rates by a historic amount and President Christine Lagarde hinted it could do the same again as part of “several” future moves. A second 75 basis-points hike next month would match the two most-recent moves by the Federal Reserve, illustrating the more aggressive approach adopted by ECB officials of late as inflation in the 19-nation euro zone breaks record after record.

Story continues below

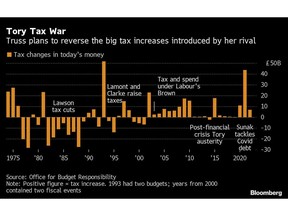

UK Prime Minister Truss, the self-styled “disruptor-in-chief” says she’s ready for unpopular decisions as she responds to the full-throttled cost-of-living crisis facing households and businesses. Both measures may upset markets over fears of stoking inflation.

European households will benefit from at least 376 billion euros ($375 billion) in government aid to stem whopping energy bills this winter, yet there’s a risk the smorgasbord of spending won’t bring enough relief. This winter will be grim across the continent. The UK, which already has the highest electricity costs in Europe, is set to see winter bills rocket by about 178%.

Asia

China’s export growth slowed more than expected in August and imports stagnated, a sign of a darkening global economic picture and weak domestic growth hit by Covid lockdowns and a property slump.

Story continues below

Taiwan’s consumer inflation cooled significantly in August, taking some of the pressure off the central bank as it tries to balance raising interest rates against the need to support the economy.

Japan’s households cut back on spending in July while real wages fell again amid a surge in virus cases and a steady increase in the cost of living, suggesting the country’s recovery path is still shaky.

US

Household net worth declined in the second quarter by the most on record as aggressive action by the Fed to tame rapid inflation sent stocks plunging. The $6.1 trillion drop pushed net worth down to $143.8 trillion, the lowest in a year.

The latest uptick in labor-force participation may not last long — the rate is projected to drop to 60.1% in 2031, compared to 61.7% in 2021, according to a report from the Bureau of Labor Statistics. That’d be the lowest since early 1973.

Story continues below

Emerging Markets

Russia may face a longer and deeper recession as the impact of US and European sanctions spreads, handicapping sectors that the country has relied on for years to power its economy, according to an internal report prepared for the government. Two of the three scenarios in the report show the contraction accelerating next year, with the economy returning to the prewar level only at the end of the decade or later.

Mexico’s annual inflation surged to the fastest pace since late 2000 in August even as US price growth begins to ease. Inflation has continued surging despite the central bank’s 10 straight rate hikes totaling 450 basis points since June last year.

World

China’s government data show foreign investment into the economy grew by almost a fifth this year, yet, a look below the 17.3% expansion in the first seven months of the year shows much of the investment into China actually comes from Hong Kong. Foreign companies are still putting new money into China, although the size and speed of that expansion is not as big as some of Beijing’s officials suggest.

As Wall Street firms order employees back to the office, the option of working from home remains more popular than ever all over the world, according to a new study. About one-third of US workers would quit or start looking for another job if told to return to the workplace five days a week, higher than the global average.

Story continues below