Article content

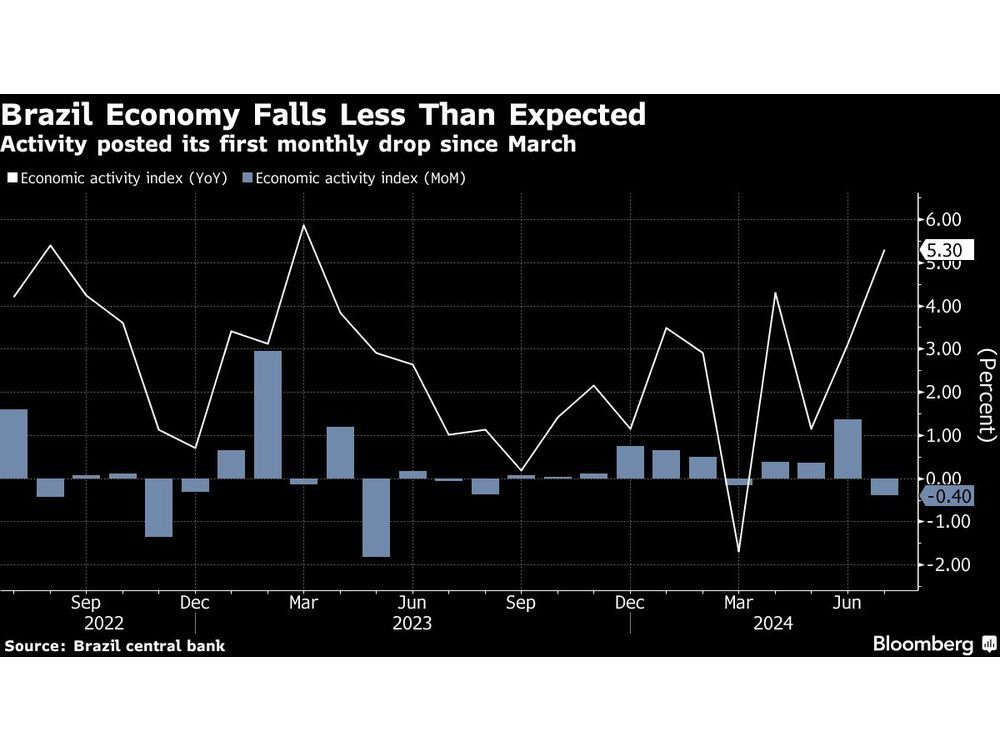

(Bloomberg) — Brazil’s economic activity fell less than expected in July, snapping a series of gains as central bankers are expected to mull the start of a cycle of interest rate hikes.

The central bank’s economic activity index, a proxy for gross domestic product, fell 0.4% from June, less than the -0.7% median estimate from analysts in a Bloomberg survey. From a year ago, the gauge gained 5.3%, according to a report published on Friday.

Article content

Brazil policymakers led by Roberto Campos Neto will still face pressure to raise borrowing costs at their Sept. 18 decision even after the July activity decline. They paused an almost year-long easing cycle in June as services costs pick up and inflation estimates run above target through 2027. Board members have said they will do “whatever it takes” to tame price growth and will approach next week’s meeting with “all options” on the table, including a hike.

Latin America’s largest economy also soared past forecasts in the first half of the year, signaling resilience to high borrowing costs. Household consumption got a boost from a firm labor market and higher public spending.

Analysts see the central bank lifting rates by a quarter-point next week, kicking off a hiking cycle that is expected to raise the benchmark Selic to 11.25% by December from the current level of 10.5%.

The most severe drought in 40 years is also sparking inflation fears, as wildfires put crops and energy supply at risk. Yet, any cost hikes in those areas are unlikely to be controlled by tighter monetary policy, Finance Minister Fernando Haddad said this week.

—With assistance from Giovanna Serafim.

Share this article in your social network