Article content

(Bloomberg) — Across Wall Street, there’s growing relief that the Federal Reserve — at long last — may be done raising interest rates. But that doesn’t mean turbulence in the bond market will soon become a thing of the past.

Investors anticipate that US Treasuries will continue to be whipsawed by heightened volatility as economic uncertainty threatens to alter the central bank’s path or keep rates pinned higher for far longer than traders currently expect.

Article content

Already, some Fed officials are underscoring that there may still be more work to do as inflation continues to hold above their 2% target despite the most aggressive monetary policy tightening in four decades. At Barclays, strategists have advised clients to sell two-year Treasuries on anticipation that rates will remain elevated next year, bucking broader speculation that the Fed will initiate a series of rate cuts as soon as March. And benchmark 10-year yields — a baseline for the broader financial system — are pushing back toward last year’s highs.

“The rise in long-dated yields has been driven by the hawkish message from the Fed,” said Rob Waldner, chief strategist fixed income at Invesco. “The central bank is staying hawkish and that’s keeping uncertainty high.”

That uncertainty, along with an increase in new debt sales as the federal government contends with mounting deficits, has weighed on the bond market. Even with the sharp jump in interest rates, the overall Treasury market returned just 0.1% this year, according to Bloomberg’s index, far short of the big gains once expected to emerge when the end of the Fed’s hiking appeared in sight.

Article content

After the central bank’s policy meeting in July, when it raised its overnight rate by a quarter percentage point, Chair Jerome Powell emphasized that its decision at the next meeting in September would hinge on the data released over the next two months.

So far, the major reports have generally supported speculation that it will hold steady in September, with job growth cooling and signs of easing inflation. But the core consumer price index — which strips out volatile food and energy prices and is seen as a better measure of underlying inflation pressures — still rose at a 4.7% annual pace in July. On Friday, an index of producer prices also rose at a faster-than-expected pace, driving up Treasury yields across maturities.

In the coming week, traders will scour the release of the minutes from the July 25-26 FOMC meeting for clues on where policymakers see rates heading and any diverging views between them.

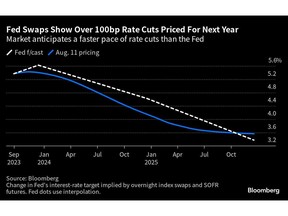

The annual gathering of global central bankers in later this month in Jackson Hole, Wyoming, will also be closely watched. It could give Powell a venue to push back on markets pricing in that the Fed will cut its key rate to around 4% by January 2025. It’s in a range 5.25-5.5% now.

Article content

“The committee is divided,” said Subadra Rajappa, head of U.S. rates strategy for Societe Generale. “The market pricing is showing a lack of conviction. Six cuts are priced in. These are not deep cuts. That’s a high-for-longer story. I cannot see a strong trade here.”

What Bloomberg Economics says…

“Minutes of the July 25-26 FOMC meeting, to be released Aug. 16, will show that a majority of Fed officials were encouraged by progress on disinflation, but not yet convinced the rate-hike cycle is over.”

— Anna Wong, chief US economist

— Read her full report, here

Even so, some investors have been pouring into the Treasury market, drawn by the higher interest rates and concern that this year’s stock market rally is unsustainable. That’s put US Treasuries on course for a record year of inflows, according to Bank of America Corp. strategists.

US Treasuries on Track for Record Year of Inflows, BofA Says

Kerrie Debbs, a certified financial planner at Main Street Financial Solutions, however, has been warning clients that bonds aren’t a sure-fire haven from risk and that the stock market’s push higher may not persist.

Article content

“There are still a whole host of events that could stall these positive market returns, including continuing inflation, perception of credit quality of US government debt, skyrocketing US budget deficits, political instability in the world and more,” said Debbs, who has around 50 clients and manages about $70 million in total assets.

What to Watch

- Economic calendar:

- Aug. 15: Retail sales; Import/export prices; Empire Manufacturing; Business inventories; NAHB Housing Market Index; TIC flows

- Aug. 16: MBA Mortgage Applications; building permits; housing starts; industrial production; FOMC meeting minutes

- Aug. 17: Jobless claims; Philadelphia Fed Business Outlook; Leading Index

- Aug. 18: Bloomberg US Aug. US economic survey

- Fed calendar

- Aug. 15: Minneapolis Fed President Neel Kashkari

- Aug. 16: FOMC minutes released

- Auction calendar:

- Aug. 14: 13- and 26-week bills

- Aug. 15: 42-day cash management bills

- Aug. 16: 17-week bills

- Aug. 17: 4- and 8-week bills

—With assistance from Edward Bolingbroke and Farah Elbahrawy.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation