Article content

(Bloomberg) — Bank of England Governor Andrew Bailey suggested that interest-rate cuts are unlikely for the “foreseeable future” as he warned that the second half of the inflation battle will be “hard work.”

He said in an interview with the Newcastle Chronicle newspaper published Monday that the recent step down in UK inflation is “very good news” but cautioned that it is unlikely to be repeated.

Article content

“We do have to get it down to 2% and that’s why I have pushed back of late against assumptions that we’re talking about cutting interest rates or we will be cutting interest in anything like the foreseeable future because it’s too soon to have that discussion,” he said.

The remarks are the latest from a BOE rate-setter to push back against the idea of starting to reverse their string of 14 hikes. Officials including Chief Economist Huw Pill have highlighted the risk of sticky domestic price pressures, evident in indicators such as wage growth and services sector inflation.

As recently as the start of last week, markets were leaning towards a cut in June next year as the economic outlook deteriorated. They are now not pricing in a reduction from the current 5.25% until August.

Stronger survey data and stimulus announced in the Chancellor Jeremy Hunt’s Autumn Statement have been among factors prompting investors to rein in their bets.

Bailey said the fight to bring inflation back to the BOE’s 2% target is a “game of two halves” that are not equal. He added that the second half is “hard work” as the external shocks to prices unwind and the rest of the task is done by restrictive monetary policy.

Article content

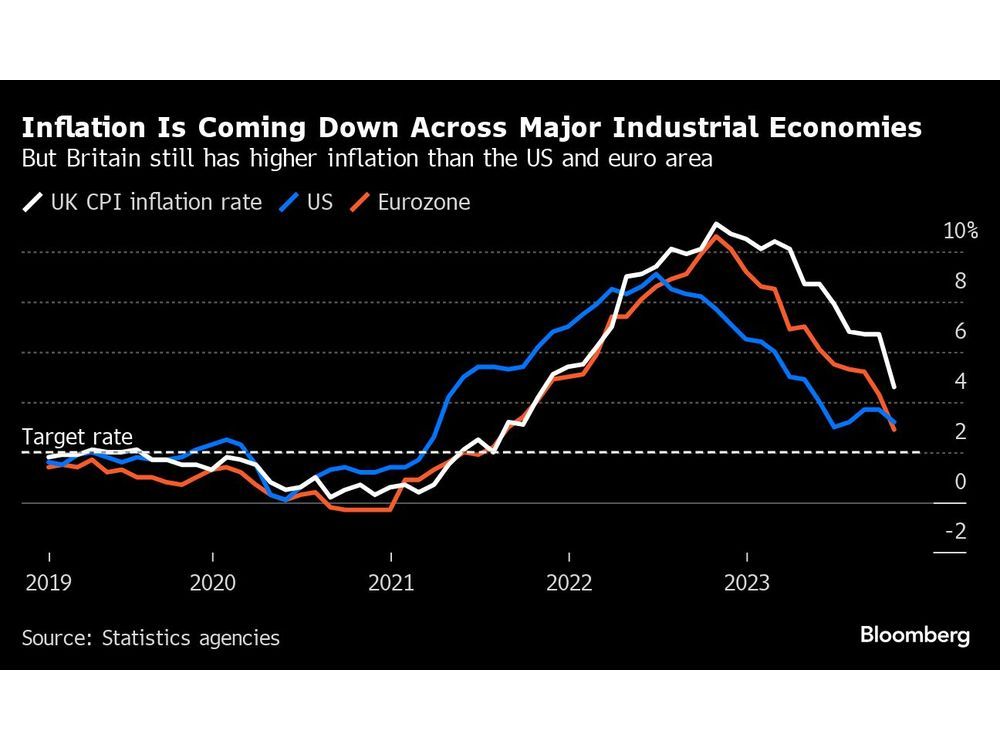

Inflation dropped sharply to 4.6% in October from 6.7% the previous month, largely due to another fall in the cost of the household energy bills under the UK’s price cap. However, Bailey said that “we’re not going to see another month, I’m afraid, where it’s going down 2% because of that.”

He said inflation may be slightly under 4% by the end of the first quarter of 2024 as the impact of price shocks abroad unwind and domestic inflationary pressures become the BOE’s primary concern.

“The second half, from there to two, is hard work and obviously we don’t want to see any more damage,” he said.

Bailey added that the backdrop is “subdued,” voicing concerns that the supply side of the economy has “slowed.”

Share this article in your social network