Article content

(Bloomberg) — Six months after rewards for validating transactions on the Bitcoin network were reduced by half, crypto mining companies are choosing between two divergent paths to remain viable.

Public miners including MARA Holdings, Riot Platforms and CleanSpark are keeping the Bitcoin they produce with the expectation that the digital asset will rise in value. At the same time, an increasing number of companies are spending more on developing data centers that power artificial intelligence applications.

Article content

The industry bifurcation has intensified since the software update in the blockchain took place in April. Called the halving, the preprogrammed event reduces the Bitcoin reward, which is the main revenue source of miners, by 50% every four years. The curtailment aims to maintain the hard cap of 21 million Bitcoin and keep the cryptocurrency from being inflationary.

“With the halving significantly squeezing profit margins, one of the few strategies available to retain investors is for miners to hold onto the Bitcoin they’ve mined, betting on future price appreciation while relying on equity or debt financing,” said Wolfie Zhao, an analyst at research firm TheMinerMag. “By avoiding the immediate sale of Bitcoin at a loss, they can keep potential losses unrealized and position themselves for gains if a bull market materializes.”

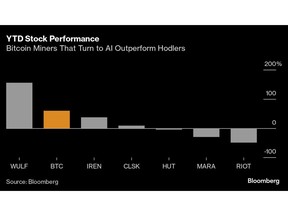

While the shares of the majority of the companies have underperformed Bitcoin’s more than 60% rally this year with future mining revenue constrained, traders appear to be voting which strategy will succeed, with those embracing AI posing the largest gains.

Article content

MARA and Riot, two of the largest publicly traded Bitcoin miners and both “hodlers,” have seen their shares slump 20% and 36%, respectively, this year. Hodl is industry slang for holding the cryptocurrency for the long term.

Core Scientific, which emerged from bankruptcy in January, has seen its stock almost quadruple since announcing a series of multibillion dollar contracts with AI upstart CoreWeave. The miner will retrofit some of its data centers to host graphics processing units that can generate high-performance computing power for AI applications. TeraWulf, whose stock has more than doubled this year, is developing AI data center space as well, granted it is a fairly small-cap stock.

Shares of other Bitcoin miners that are dedicating more resources to AI such as Iris Energy and Bit Digital tend to trend above some of their peers that are doubling down on holding the Bitcoin they mine.

It remains unclear what will prove to be the winning strategy. While AI is all the rage, there have been signs of cooling interest in the sector. There are also questions about whether some of the Bitcoin miners have enough resources and a strong enough commitment to join the AI race as that is a capital-intensive process.

Article content

In the meantime, the Bitcoin-holding miners have become better at timing the cycles of the crypto market after suffering from a industry meltdown in the past few years. For some companies, especially the large-scale operators such as MARA and CleanSpark, Bitcoin mining is still profitable with positive gross margins.

“Our view is that pure-play Bitcoin mining has a place in the market currently with the respect to generating economic value from growing capacity to mine Bitcoin,” said Paul Golding, a senior analyst at Macquarie Capital USA. He has “outperform” ratings on MARA, Riot, Core Scientific, Iris Energy, CleanSpark and Cipher Mining.

Advances in the efficiency of the hardware as well as potential appreciation in Bitcoin are among the reasons that miners can keep viable from a gross margin perspective even after the halving, Golding said.

With Bitcoin rising again in the wake of the 2022 market collapse, miners have resumed borrowing, as well as issuing more shares. And this time around, companies such MARA are even using the proceeds to purchase crypto, emulating the buy-and-hold strategy MicroStrategy has used to morph from an little-known enterprise software maker to the world’s most prominent Bitcoin proxy.

“In a rising Bitcoin price environment, it is going to be an extremely successful strategy, but it’ll be a disaster if Bitcoin prices plummet,” said Ethan Vera, chief operating officer at Luxor Technology. “You will continue to see negative profits and they are hiding how bad the industry is right now and how bad their operations are by diluting shareholders and buying newer machines.”

Share this article in your social network

Comments