Article content

(Bloomberg) — Traders hoping to profit from a surprise reading in Wednesday’s consumer inflation data may be better off positioning for it to come in below forecasts, according to JPMorgan Chase & Co.’s sales and trading desk.

Traders hoping to profit from a surprise reading in Wednesday’s consumer inflation data may be better off positioning for it to come in below forecasts, according to JPMorgan Chase & Co.’s sales and trading desk.

(Bloomberg) — Traders hoping to profit from a surprise reading in Wednesday’s consumer inflation data may be better off positioning for it to come in below forecasts, according to JPMorgan Chase & Co.’s sales and trading desk.

Story continues below

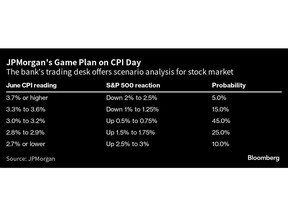

While the consensus estimate for June’s consumer price index is for a 3.1% annualized pace, the bank’s team including Andrew Tyler sees a four-in-five chance for the data to arrive in line or below the estimate, a range of outcomes that can bolster equities, all else equal.

In two contrasting tail-risk scenarios where the CPI reading presents a market shock, the team assigns a 10% probability that inflation slows drastically and the S&P 500 surges in response. Those odds are twice as high as the opposite situation, where a significant rebuilding in pricing pressures sends stocks reeling.

Put another way, the team expects a yearlong inflation slowdown to allow the Federal Reserve to ease off its monetary tightening campaign, a backdrop that bodes well for stocks.

Story continues below

“Think this print pushes the market closer to Goldilocks where we have economic growth, earnings growth, and normalized inflation,” Tyler and his colleagues wrote in a note to clients this week. “While the bull case does not require a pause/skip at the July Fed meeting, it would certainly magnify the upside potential.”

In the most likely scenario laid out by the team, CPI comes in between 3% and 3.2%, and the S&P 500 adds 0.5% to 0.75%. An inflation reading at 2.7% or lower is expected to spark a rally of at least 2.5% in the equity benchmark.

The trajectory of inflation has become a focal point for Wall Street traders in recent years, particularly after the Fed under-estimated the stickiness of pricing pressure and then rushed to hike interest rates at a pace not seen in decades.

Story continues below

Market volatility regularly spiked around the release in 2022 though angst has receded this year. The Cboe 1-Day Volatility Index, a gauge of the S&P 500’s expected price swings in the next 24 hours, last traded near 16. That’s lower than any pre-CPI sessions in data going back to May 2022. Still, the gameplan from JPMorgan’s team shows the stakes are high for investors.

To be sure, gaming on CPI day isn’t straightforward. For one, there are different flavors for the data, and people disagree on which is more important for traders. While the JPMorgan team focused on the headline number, a survey by 22V Research placed emphasis on so-called core inflation, which strips out food and energy.

In 22V’s survey of clients, almost two-thirds of the respondents expect core CPI to be lower than the 5% forecast by economists in a Bloomberg survey. About 54% of them consider the event as risk-on.

The S&P 500 has moved an average 1.6% on CPI days in the past year. This time, the implied move from the options market is around 0.7%, according to Danny Kirsch, head of options at Piper Sandler & Co.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation