Article content

(Bloomberg) — One of the best trades in global commodities could be in the UK’s carbon market.

Andurand Capital Management, run by famed oil trader Pierre Andurand, is betting that UK carbon prices are going to rise in the coming months. A push from the government on climate policies could make the market a bright spot as other commodities markets cool after years of soaring prices.

Article content

Britain launched its carbon market in 2021 after it left the European Union. While the country has maintained its longterm ambition to cut greenhouse gases since then, its carbon price currently trades at a more than 20% discount to its much larger EU equivalent. With the Labour government looking to fill a £22 billion ($28.8 billion) hole in the country’s finances and speed up decarbonization, a higher carbon prices would help deliver both.

The government auctions carbon permits and the Treasury gets the proceeds.

“There’s an opportunity here,” Mark Lewis, head of research and portfolio manager at the fund, said in an interview. “This is a significant-policy driven catalyst. Those catalysts don’t exist in other markets.”

Lewis, who helps manage the Andurand Climate and Energy Transition Fund, expects the price of UK allowances to rise above £60 per ton, up from £42 currently, and trade closer in line with the EU market.

Carbon markets in Europe require power plants and industrial companies to buy a permit for each metric ton of carbon emissions they release into the atmosphere. Moves by the EU to tighten its carbon market in recent years to help deliver plans to reach net zero emissions by the middle of the century helped push up the bloc’s carbon price by nearly 150% in 2021.

Article content

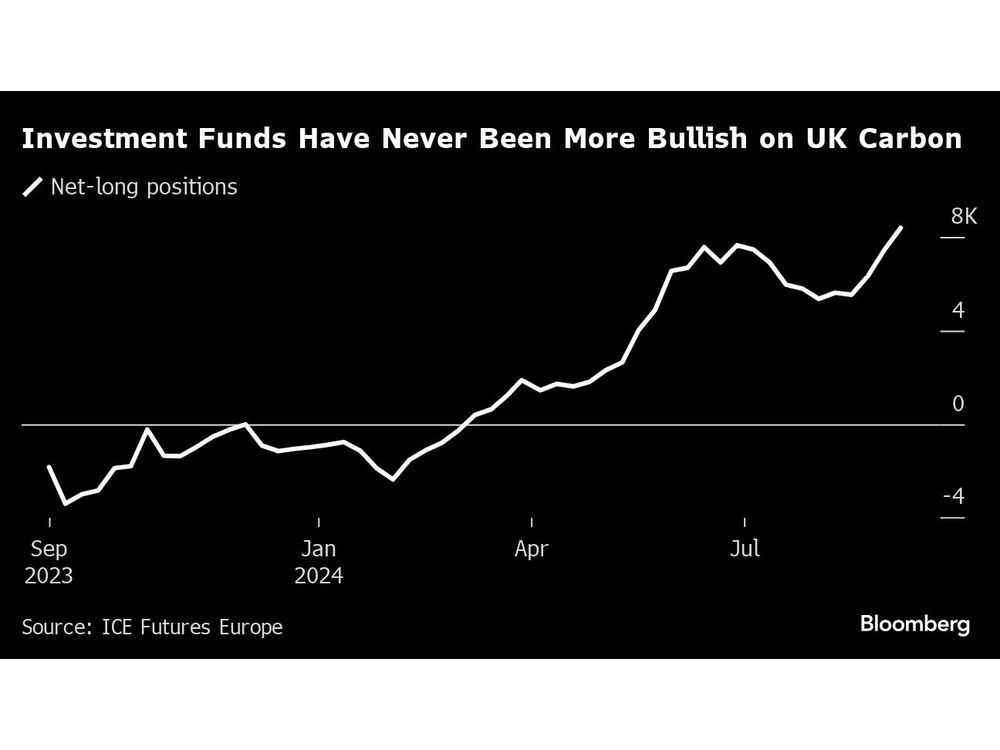

Hedge funds, including Andurand, profited from the policies by betting that the emissions price would rise. Now investors are increasingly shifting their bets to the UK market. At the end of last week, investment funds placed a record amount of bets that the market price would increase, according to data published by ICE Futures Europe.

In the coming months, a number of possible developments would help push prices higher. Chief among those is the potential to link the UK market to the European one so that permits bought in either system could be surrendered in the other one. Even early signals that the UK wants to link to Europe would drive the prices to converge.

News on increasing the market’s floor price, the introduction of a mechanism that could remove excess permits from the market and measures to reduce the amount of permits given away for free to industrial companies would also boost UK carbon prices.

“UK allowances are seen as one of the most interesting markets in the compliance carbon world at the moment,” said Serafino Capoferri, who leads carbon markets research at Macquarie Bank Ltd.

Still, there are risks. It’s not clear when any changes to the carbon market will come. Meanwhile, demand for UK emissions permits is weak as an increasing amount of wind power decreases demand from the power sector.

“Overall, longer term, it’s a bullish view, but in the meantime before the details are out there’s some uncertainty,” said Henry Lush, who focuses on carbon at Oslo-based analysis firm Veyt.

Share this article in your social network