| Criteria |

JORC Code explanation |

Commentary |

| Mineral Resource estimate for conversion to Ore Reserves |

Description of the Mineral Resource estimate used as a basis for the conversion to an Ore Reserve. |

The Mineral Resource estimate (MRE) used was prepared by Mining Plus Pty Ltd under the direction of Allkem and classified in accordance with the JORC 2012 guidelines. The MRE was natively prepared in Datamine software with a record date of 31 December 2022, and a summary was released to the ASX on 17 April 2023.

The MRE was transformed into a diluted, regularised, mining model inclusive of mining recovery, by Orelogy Mine Consulting.

Reconciliation between the two models was considered acceptable, and the inbuilt dilution and mining recovery reflect the historical values of 17% dilution and 94% mining recovery which were derived from site model to process plant reconciliations. |

| Clear statement as to whether the Mineral Resources are reported additional to, or inclusive of, the Ore Reserves. |

The Mineral Resources are reported inclusive of the Ore Reserves. |

| Site visits |

Comment on any site visits undertaken by the Competent Person and the outcome of those visits.

If no site visits have been undertaken indicate why this is the case. |

The Competent Person has undertaken a site visit within the current reporting period. |

| Study status |

The type and level of study undertaken to enable Mineral Resources to be converted to Ore Reserves.

The Code requires that a study to at least Pre-Feasibility Study level has been undertaken to convert Mineral Resources to Ore Reserves. Such studies will have been carried out and will have determined a mine plan that is technically achievable and economically viable, and that material Modifying Factors have been considered. |

Mt Cattlin is a mature operating mine and a Feasibility Study (FS) investigating the continuation of current operations is the basis of the conversion of the MRE to an ORE.

The FS has addressed all material Modifying Factors required for the conversion of Mineral Resources to Ore Reserves and has shown that the mine plan is technically achievable and economically viable. Where possible and appropriate, the FS has used parameters in line with the current operations. |

| Cut-off parameters |

The basis of the cut-off grade(s) or quality parameters applied. |

A marginal cut-off grade of 0.3% Li2O has been used for reporting the ORE.

The economic cut-off grade calculation is approximately 0.2% Li2O, but the more conservative cut-off grade was adopted based on historical operating experience as an approximation of the practical process plant recovery constraint. |

| Mining factors or assumptions |

The method and assumptions used as reported in the Pre-Feasibility or Feasibility Study to convert the Mineral Resource to an Ore Reserve (i.e., either by application of appropriate factors by optimisation or by preliminary or detailed design). |

An optimisation of the MRE was undertaken with General Mine Planning (GMP) software, both Geovia and Datamine products. Comparisons between the outputs showed them to be materially equivalent.

The addition to the specific modifying factors described in the sub-sections below, the optimisation data inventory and input parameters included:

- Regularised mining model created from the MRE that included dilution and mining recovery

- Surveyed surface topography provided from Mt Cattlin as at 01/07/23

- Contract mining costs from a competitive tender process

- Closure costs from the site Mine Closure Plan cost estimate

- Spodumene concentrate (SC5.4) revenue price of US$1,500/t inclusive of shipping and marketing costs

- Tantalite concentrate revenue from current sales contract

- State Government and third-party royalties

- Processing, General & Administration, concentrate surface haulage, and port costs from current site budgets and forecasts (based on actual data)

- Net Present Value (NPV) discounting rate of 10%

Where supplied by Allkem, these input parameters were reviewed by Entech and considered appropriate for the current spodumene concentrate market.

The staged pit design and schedule is considered suitable for Ore Reserve estimation.

|

| The choice, nature and appropriateness of the selected mining method(s) and other mining parameters including associated design issues such as pre-strip, access, etc. |

The ORE includes the Stage 4 North-West (NW) pit which is a down dip extension of the current Stage 3 NW pit i.e., deepening of current floor, and cutting back of the current pit rim.

The mining methodology is a continuation of the conventional hard rock open cut practices of the current operations with continuous drill, blast and excavate cycles (with ore grade control as required).

The existing operations provide access to the operations of the ORE. |

| The assumptions made regarding geotechnical parameters (e.g., pit slopes, stope sizes, etc), grade control and pre-production drilling. |

A comprehensive geotechnical study appropriate for an FS level was undertaken by Entech to determine the pit design parameters used in the ORE. Three dedicated geotechnical diamond drill holes, totalling 651 m, located in the vicinity of the final pit walls were drilled, logged, sampled and laboratory tested to collect detailed geotechnical data. In addition, photogrammetric modelling of the current pit walls, structure digitisation, in-pit mapping and data from previous studies was utilised to characterise the rock mass and provide input data for stability analysis that were used to derive the recommended design parameters.

97% of the rock within the pit containing the ORE is competent fresh (unweathered) material, and key design parameters derived for fresh rock were:

- 20 m bench height

- 70o bench face angle

- 8.5 m wide spill berm

- 52o inter-ramp angle

- 12 m wide geotechnical berm every approx. 100 m of high wall face

Pit designs were reviewed by Entech’s Principal Geotechnical Engineer to ensure compliance with geotechnical intent.

In conjunction with the Mineral Resource and grade control predictive computerised block models, established site grade control procedure utilises visual inspection of blast hole cuttings and pit-floor visual geological control when mining ore (“ore spotting”). The combination of techniques enables identification and segregation of barren pegmatite or pegmatite containing fine grained spodumene, from pegmatite containing coarse grained spodumene (ore). Specific grade control drilling campaigns (RC technique) are used in areas of higher structural or mineralogical uncertainty.

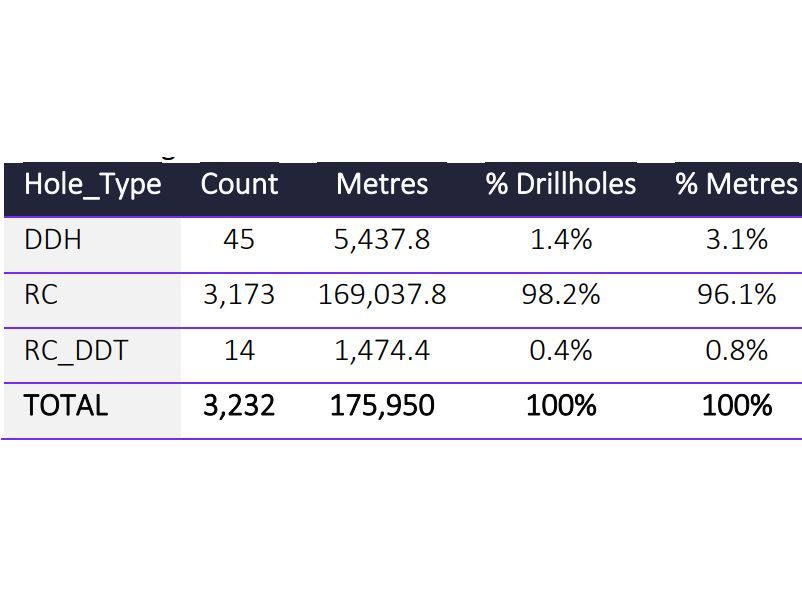

Mt Cattlin is an operating mine with current production and excavation knowledge. The resource drilling that defines the Stage 4 expansion is +95% Reverse Circulation (RC), and predominantly spaced at 40 m x 40 m.

|

| The major assumptions made, and Mineral Resource model used for pit and stope optimisation (if appropriate). |

The underlying Mineral Resource model was jointly developed by independent consultant Mining Plus Pty Ltd and Allkem Ltd (see ASX release 17 April 2023). A dilution study was then carried out by consultant Orelogy Mine Consulting (Orelogy) to determine the appropriate methodology to create a diluted, regularised Mining Model that could be readily used in GMP software. The key steps and outcomes from the dilution study and modifications to create the Mining Model were:

- Regularising the block size into Selective Mining Unit (SMU) dimensions of 5.0 m x 5.0 m x 2.5 m (East, North, Elevation).

- The SMU size was selected based on the size of the equipment, the parent and sub cell block sizes in the resource model and matched the existing mining bench height to the vertical dimensions of the block.

- The ore blocks were flagged as either “Clean” (uncontaminated with mining dilution) or “Contaminated” (contaminated with basalt country rock and requiring beneficiation by optical sorting prior to being processed) ore types depending upon the proportion of clean ore within the SMU block.

- The overall model reports 82% of the ore to the Clean category and 18% to the Contaminated category.

|

| The mining dilution factors used. |

No external dilution factors have been applied. The Mining Model described above compared to the source undiluted model has a back-calculated dilution of 16%. |

| The mining recovery factors used. |

No external mining recovery factors have been applied. The Mining Model described above compared to the source undiluted model has a back-calculated ore loss of 5.7%. |

| Any minimum mining widths used. |

A minimum mining width of 40 m has been applied in the pit designs. |

| The manner in which Inferred Mineral Resources are utilised in mining studies and the sensitivity of the outcome to their inclusion. |

Inferred Mineral Resources comprise 12% of the MRE and were used to inform the optimisation.

The designed pit inventory has 0.5% of Inferred Mineral Resource which has been treated as waste for the economic assessment. The design of the pit is not sensitive to the inclusion, or not, of Inferred Mineral Resource. |

| The infrastructure requirements of the selected mining methods. |

The ORE as an extension of current operations, and the current site infrastructure is suitable for proposed mining methods. |

| Metallurgical factors or assumptions |

The metallurgical process proposed and the appropriateness of that process to the style of mineralisation. |

Ore is processed through the existing crushing, screening, ore sorting, and heavy media separation (HMS) plant with a nominal and permitted capacity of 1.8 Mt per annum. The Mt Cattlin plant has been in operation for over a decade and is suitable for this style of mineralisation. |

| Whether the metallurgical process is well-tested technology or novel in nature. |

The Mt Cattlin plant is comprised of well tested technology and suited to the production of saleable spodumene concentrate.

Several ancillary circuits have been added over the life of the plant including optical ore sorters and fines recovery to incrementally enhance project economics. All the processing technology has been in use in this or other configurations for numerous to many years and are not regarded as novel. |

| The nature, amount and representativeness of metallurgical test work undertaken, the nature of the metallurgical domaining applied and the corresponding metallurgical recovery factors applied. |

As an operating processing facility, the Mt Cattlin plant has amassed significant knowledge and expertise in the treatment of the Mt Cattlin ores.

Fine grained spodumene recovers poorly in the Mt Cattlin processing plant. The underlying MRE model has explicitly domained the fine-grained material and excluded it from the new in-situ MRE inventory.

Confirmatory metallurgical test work on ore in the Stage 4 extension is in progress.

A regression formula developed from historical operating performance that uses head grade to predict plant recovery, for a given grade of concentrate, is in daily use at Mt Cattlin. The Feasibility Study has used this algorithm to calculate metallurgical recovery in the economic analysis. |

| Any assumptions or allowances made for deleterious elements. |

Allowances have been made for iron oxide (Fe2O) content of the spodumene concentrate. The (potential) penalty element is estimated in the MRE, reported in the ORE, monitored during processing, and quantified in the final spodumene concentrate product. Revenue pricing used in the cashflow model incorporates likely penalty charges. |

| The existence of any bulk sample or pilot scale test work and the degree to which such samples are considered representative of the orebody as a whole. |

The ORE is a continuation of the ore zones that have been successfully mined and processed at Mt Cattlin. Bulk samples and/or pilot scale testing is not required due to the demonstrated process flowsheet performance. |

| For minerals that are defined by a specification, has the ore reserve estimation been based on the appropriate mineralogy to meet the specifications? |

The Ore Reserves have been based on lithia (Li2O), Tantalite (Ta2O5), and iron oxide (Fe2O) grade ranges that are acceptable to existing sales contracts and readily saleable into the international market. |

| Environmental |

The status of studies of potential environmental impacts of the mining and processing operation. Details of waste rock characterisation and the consideration of potential sites, status of design options considered and, where applicable, the status of approvals for process residue storage and waste dumps should be reported. |

The Mt Cattlin mine site is an operating and mature operation with well-understood impacts and established environmental management systems and capability. The site operating procedures are consistent with the principles of ISO 14001:2015 Environmental Management Systems.

Key potential risk areas include noise, vibration and air emissions/quality are regulated, and have specific management plans to ensure compliance.

Waste rock and processing tails stored on site are classified as Non-Acid Forming (NAF) and chemically benign. The waste rock is predominantly unweathered (fresh), competent, basalt and andesites which form stable and erosion resistant landforms. Mt Cattlin pegmatite tailings are a coarse, sandy, material that drains readily and exhibits excellent stability on placement. The Heavy Media Separation process used to produce spodumene concentrate does not introduce chemicals into the tailings stream.

A 2023 Mining Proposal for pit and waste dump expansion required for part of this ORE has been submitted to the WA regulator, with approval expected in the third quarter of 2023. Further approvals will be required during the life of this ORE, potentially including pit and waste dumping area increases and a new In-Pit Tailings Storage Facility.

There is no reason to expect that all required approvals cannot be gained in sufficient time to allow the exploitation of this ORE as planned. |

| Infrastructure |

The existence of appropriate infrastructure: availability of land for plant development, power, water, transportation (particularly for bulk commodities), labour, accommodation; or the ease with which the infrastructure can be provided, or accessed. |

The Mt Cattlin mine site is a mature operating mine. All mining, processing, power and water supplies, road and port infrastructure are in place and operational.

Accommodation is based near site for a mixed commute and residential workforce. The operation has access to a nearby regional bituminised airstrip capable of landing 100-seat jets. Sealed roads link the site to Perth, and major regional towns. |

| Costs |

The derivation of, or assumptions made, regarding projected capital costs in the study. |

The FS has assessed and included appropriate capital costs. As an existing operation the capital required for the operating life of the ORE is not significant. |

| The methodology used to estimate operating costs. |

The operating costs have been derived two sources:

- contract mining costs – competitive market tender

- all other operating costs – from analysis of the site FY24 forecast (which is derived from actual historical costs and existing contracts)

|

| Allowances made for the content of deleterious elements. |

The revenue prices used in the economic analysis have incorporated all applicable penalty charges as modelled, including deductions for product grade less than the benchmark 6.0% spodumene grade (SC6), and for any iron oxide content above limits.

The charges are not material in the overall pricing. |

| The source of exchange rates used in the study. |

The exchange rate of consequence is Australian to United States of America (USD:AUD) currency exchange rate as spodumene product is sold in US dollars (USD). As an existing Western Australian based operation, most costs are in denominated in AUD.

A flat 0.70 USD:AUD exchange rate was used in the cashflow modelling that was provided by Allkem. |

| Derivation of transportation charges. |

Product transportation and handling charges (road haulage from Mt Cattlin to Esperance port, and Esperance port costs) were provided by Allkem and were derived from existing contracts.

The product revenue price used was discounted to be net of sea freight. |

| The basis for forecasting or source of treatment and refining charges, penalties for failure to meet specification, etc. |

The headline external pricing forecasts for spodumene concentrate grading 6.0 % Li2O were discounted for expected product grades of between 5.2% Li2O and 5.5% Li2O. The discounts were derived from existing contract penalty charges. Penalties were also applied to Fe2O3 exceedances if they occurred. |

| The allowances made for royalties payable, both Government and private. |

Selling costs have allowed for a 5.0% ad-valorum Western Australian state royalty and $1.50/t of ore processed third party royalty. |

| Revenue factors |

The derivation of, or assumptions made regarding revenue factors including head grade, metal or commodity price(s) exchange rates, transportation and treatment charges, penalties, net smelter returns, etc. |

The ORE head grade is reported by the GMP software interrogating the diluted mining model within the designed pit. Normal good practice checks have been made in this process, as well as reporting through alternative GMP software, and comparing to similar internal work by Allkem.

The spodumene concentrate commodity price used in the cashflow model is based on pricing by an external independent market forecaster, with appropriate modifications for Mt Cattlin product specification. Allowances have been made for surface and sea freight charges based on current site budgets and forecasts. The realised price (i.e., FOB; net of charges) forecast over the likely period the product from this ORE will be sold into market has an average of A$2,978/dmt and a median of A$2,963/dmt.

Minor revenue is derived from the sale of a by-product Tantalite concentrate and the sale price used is based on current contracts which average approximately A$35/ dry lb.

Transport charges are derived from existing contracts, and likewise penalty charges are taken from existing sales contracts.

|

| The derivation of assumptions made of metal or commodity price(s), for the principal metals, minerals and co-products. |

As described above, the commodity price assumptions have been taken from independent market analysts and existing contracts and are deemed appropriate. |

| Market assessment |

The demand, supply and stock situation for the particular commodity, consumption trends and factors likely to affect supply and demand into the future. |

An Independent market researcher (commercial in confidence) forecasts for demand, supply, and stock levels during the likely market window of the product of this ORE have been used to characterise the international market for spodumene concentrate.

The demand for spodumene concentrate is primarily driven by automotive batteries, and the underlying strong global growth in electric vehicles. From extreme deficit in supply over the past two years that has seen steep price growth and incentive for new supply, it is forecast that the overall market is moving into surplus, with intermediate fluctuations, until the end of the decade, from where it will again retreat into deficit.

The accuracy of these forecasts will be dominated by the accuracy of the assumptions quantifying the rate of growth in mine supply, and the rate of growth of EV sales. |

| A customer and competitor analysis along with the identification of likely market windows for the product. |

The Mt Cattlin spodumene concentrate is currently sold through offtake agreements mainly to mainland Chinese convertors. Offtake agreements have pricing conditions reflecting spodumene market prices.

During the market window applicable to this ORE, the Mt Cattlin product moves from being fully contracted, to a mix of contract and spot market exposure, to fully available for spot pricing. This mix of contract vs. spot markets exposure is subject to continuous review and adjustment.

Significant global supply chain diversification is underway which is seeing new lithium processing plants being developed in countries other than China, adding diversification to the potential customer base. |

| Price and volume forecasts and the basis for these forecasts. |

Overall market supply and demand, along with customer and competitor factors have been considered in the compiling of the pricing forecast applicable to this ORE.

The optimisation price selected of US$1,500/t of spodumene concentrate was conservatively lower than the average pricing forecast of the likely market window. The cashflow model pricing used was based on the current forecasts for the likely market window, modified for the specification of the Mt Cattlin product, as discussed above in the Revenue Factors section. It is assumed that all product produced is sold into existing contracts and spot markets. |

| For industrial minerals the customer specification, testing and acceptance requirements prior to a supply contract. |

Mt Cattlin concentrates are sold into typical international specifications, the more relevant specifications being Li2O grade, Ta2O5 grade (both revenue factors), and Fe2O3 grade (a potential penalty factor). Mt Cattlin product does not typically attract Fe penalties, and the lithia grade is forecast to range between 5.5% Li2O and 5.2% Li2O depending on market assessment.

Customer specification and acceptance of the product rely on a typical process of samples taken by an independent agency and conformance of the assays obtained by both the seller and buyer to an allowable range of variance. |

| Economic |

The inputs to the economic analysis to produce the net present value (NPV) in the study, the source and confidence of these economic inputs including estimated inflation, discount rate, etc. |

The cashflow model is uninflated and applies a 10% discount rate to calculate the project NPV, which was robustly positive.

Mining costs were derived by a competitive market tender process based on a designed and scheduled pit, and existing site infrastructure. Processing, General & Administration, product haulage, port, and shipping costs reflect corporate forecasts based on historical site actual data modified for Allkem’s view on FY24 market conditions.

As an ongoing operation, capital costs were relatively minor but included an allowance for developing a new In-Pit Tailings Storage Facility (IPTSF) during the life of mine, buffering land purchases, as well as ongoing sustaining capital. An end of mine allowance of $17.5 M has been incorporated into the economic analysis.

The overall cost base assumptions and analysis methodology are considered appropriate, robust and at FS level of accuracy. |

| NPV ranges and sensitivity to variations in the significant assumptions and inputs. |

The cashflow model has been tested for sensitivity to key economic assumptions. As is typically found, the revenue assumptions (e.g., sale price, USD:AUD exchange rate, head grade, plant recovery) have a much greater influence than cost assumptions (e.g., operating costs, capital costs). At 20% individual variances to any of these variables the project remains robustly economic over life of mine and generates positive cashflows.

Stripping Ratio is generally a proxy for risk, and the individual stages of the overall project (as currently evaluated) have quite different stripping ratios than the overall project average. The NPV sensitivity to key variables is therefore significantly different if analysed by stage. If the most sensitive stage (Stage 4-1) is assessed by the most influential variable (Revenue) at the most negative value (-20%), the cashflow is weakly positive whilst the NPV falls to zero. The following stage (Stage 4-2) and the sum of the two stages (Stage 4-1 + Stage 4-2) remain with strongly positive cashflows and NPV’s when Revenue is tested at -20%. |

| Social |

The status of agreements with key stakeholders and matters leading to social licence to operate. |

As an operating site Mt Cattlin has a well-established and implemented Environmental Management Plan and suite of operating procedures consistent with the principles of ISO 14001:2015 Environmental Management Systems and includes, but is not limited to:

- Environmental Policy

- Requirements of approvals, permits and licences

- Environmental responsibilities of site personnel

- Site induction programmes

- Environmental monitoring and reporting requirements

- Inspection and audit process

- Non-conformance, corrective action, and risk management of incidents

- Preparation of procedures and work instructions addressing identified elements such as dewatering, saline spillage, waste management and bioremediation

- Stakeholder consultation, including:

- Regular update meetings with Shire of Ravensthorpe and Ravensthorpe Business Association

- Ongoing consultation with local neighbours

- Ongoing consultation with Traditional Owner groups and presentations at the Southwest Aboriginal Land and Sea Council working party meetings

- Appointment of an Environmental and Community Liaison Officer

- Biannual presentations to the Ravensthorpe community

- Establishment of the Mt Cattlin Community Consultation Group in 2018 with members consisting of respected leaders of the community and Mt Cattlin senior management. Minutes of meetings and presentations are made publicly available via https://www.mtcattlin.com.au/ccg/

Allkem have advised the Competent Person that there are no current issues that would be expected to endanger the ‘social licence to operate’.

|

| Other |

To the extent relevant, the impact of the following on the project and/or on the estimation and classification of the Ore Reserves: |

Commentary below. |

| Any identified material naturally occurring risks. |

The FS has investigated the potential for flooding via a hydrology study which informed the design of the abandonment bund and the Cattlin Creek diversion channel and associated bunding. No residual issues were apparent.

The TSF design has included analysis of performance under seismic conditions, which was found to be acceptable.

The life of the ORE at less than five years is considered too short to be meaningful affected by longer term climate change. Short term variability in the form of floods or droughts is unlikely to materially affect the operation.

The site continued operating through the recent global pandemic. |

| The status of material legal agreements and marketing arrangements. |

All material legal and marketing agreements are in place and accounted for. |

| The status of governmental agreements and approvals critical to the viability of the project, such as mineral tenement status, and government and statutory approvals. There must be reasonable grounds to expect that all necessary Government approvals will be received within the timeframes anticipated in the Pre-Feasibility or Feasibility study. Highlight and discuss the materiality of any unresolved matter that is dependent on a third party on which extraction of the reserve is contingent. |

The ORE stated are located on active mining leases, in good standing.

All required permits for the current Stage 3 works, which represents approximately 40% of this ORE, are approved and are in place.

A Mining Proposal that describes the first phase of the Stage 4 expansion has been submitted to the WA Regulator for approval, which is expected in August 2023. In addition to the usual technical and regulatory compliance assessment that defines Mining Proposal assessment, a tenement status conversion from an Exploration Licence (E) to a General Purpose Licence (G) is required to enable waste dumping as a permitted activity, and the Mining Proposal to be subsequently approved. The E is held by Allkem and is in good standing, and the conversion to a G is expected to happen in May 2023 as per standard procedure in the timeframe estimated for overall Mining Proposal approval.

Post receipt of the Mining Proposal approval described above, subsequent permitting applications will then be made for the second phase of the Stage 4 expansion, including the next In-Pit Tailings Storage Facility (IPTSF). The second phase approvals are expected to be gained by the end of the first quarter of 2024, allowing sufficient time, including contingency, before the planned works are required to commence. |

| Classification |

The basis for the classification of the Ore Reserves into varying confidence categories. |

The Mineral Resources above an in-situ economic cut-off grade within the designed open pit and below the surveyed topography surfaces (as of 31 March 2023) have been modified by the application of suitable modifying factors and has been classified Probable, based on the Measured or Indicated classification of the Mineral Resource estimate.

The surface stockpiles are classified as Probable Ore Reserves to simplify reporting. Some stocks such as ROM ore would normally qualify as Proved, but the downgrading is not material to the ORE.

The level of work undertaken through the FS is considered sufficient for the classification of Proved and Probable Ore Reserves. |

| Whether the result appropriately reflects the Competent Person’s view of the deposit. |

Mr. Daniel Donald, the Competent Person for this Ore Reserve estimation, has reviewed the work undertaken to date and considers that it is sufficiently detailed and relevant to allow declaration of these Ore Reserves. |

| The proportion of Probable Ore Reserves that have been derived from Measured Mineral Resources (if any). |

As described above, all surface stocks have been classified as Probable when it may have been possible to classify some as Proved. Any potential upgrading would have no material effect on the ORE. |

| Audits or reviews |

The results of any audits or reviews of Ore Reserve estimates. |

The Ore Reserve has been estimated by independent consultants Entech Pty Ltd with assistance from Allkem and Strategic Metallurgy with the MRE, mining model, and processing areas respectively.

Entech have undertaken internal peer review during the process. |

| Discussion of relative accuracy/ confidence |

Where appropriate a statement of the relative accuracy and confidence level in the Ore Reserve estimate using an approach or procedure deemed appropriate by the Competent Person. For example, the application of statistical or geostatistical procedures to quantify the relative accuracy of the reserve within stated confidence limits, or, if such an approach is not deemed appropriate, a qualitative discussion of the factors which could affect the relative accuracy and confidence of the estimate. |

The Competent Person deems that the methodology applied to arrive at the Ore Reserve estimate for Mt Cattlin is appropriate and defendable.

The overall accuracy of the cost estimate used in the ORE is considered to be ±15%. The cost estimates have been derived from competitive market tender for mining costs, and actual site operating data for processing and General and Administration (G&A) costs, so the global accuracy is considered robust.

The current South-East In-Pit Tailings Storage Facility (SE IPTSF) capacity will be reached by the second-half 2024, and deposition will switch to the nearby NE IPTSF, which will have capacity for the remainder of the life of mine. The detailed design, costing and permitting of the NE IPTSF has not yet been finalised. Whilst the NE IPTSF capital expenditure (capex) is immaterial in the overall project cashflow, the estimation has been conservatively calculated and is at a PFS, rather than FS-level of accuracy. There is no reason to expect that permitting approvals will not be gained for the proposed NE IPTSF when applied for.

The Probable ore stockpiles include 900 kt @ 0.8% Li2O of tailings from early project life that are planned to be retreated at mine closure. The economic analysis test has used conservative metal recovery (30%) and product grade specifications (4.5% Li2O) indicated from metallurgical test work to date. Test work is continuing and flowsheet development is also underway but currently the level of accuracy is PFS rather than FS. The contribution of the tailings retreatment at mine closure is not considered material to the overall project. |

| The statement should specify whether it relates to global or local estimates, and, if local, state the relevant tonnages, which should be relevant to technical and economic evaluation. Documentation should include assumptions made and the procedures used. |

The statement relates to global estimates of a mine scale. |

| Accuracy and confidence discussions should extend to specific discussions of any applied Modifying Factors that may have a material impact on Ore Reserve viability, or for which there are remaining areas of uncertainty at the current study stage. |

Confidence in the application of the modifying factors is appropriate for the estimate.

Historically disproportionate amounts of fine-grained ore in the ROM feed negatively affected plant recovery in the second half of 2022. This has since been identified in the Mineral Resource and domained out of the new MRE which underpins this ORE.

|

| It is recognised that this may not be possible or appropriate in all circumstances. These statements of relative accuracy and confidence of the estimate should be compared with production data, where available. |

The contract mining cost data which was derived from competitive market tender has also been compared to actual site production data. All other operating cost data is directly derived from actual production data. In summary, the cost data used compares very well with production data and incorporates the inflationary/pandemic effects seen over the previous several years.

Processing plant throughput and recovery data has been derived directly from production data, and therefore compare very well.

The mining model used to evaluate the ORE incorporates regularised blocks at SMU size, and mining dilution and mining recovery derived from actual production data and plant reconciliations. This new mining model has only been used in three month-end reconciliation at this point in time. The new model is expected to continue to reconcile well due to the technical improvements described above. |