Article content

(Bloomberg) — Allegro Microsystems Inc. is drawing takeover interest from larger competitor ON Semiconductor Corp., according to people familiar with the matter.

Article content

Phoenix-based ON Semi has been working with advisers in recent months to pursue Allegro, the people said, asking not to be identified because the matter is private.

It’s possible other suitors could emerge for Allegro and the company hasn’t indicated whether it would be open to a potential sale, they added.

Article content

Semiconductor companies interested in bulking up their automotive capabilities could look at buying Allegro, the people said.

A representative for ON Semi declined to comment. A representative for Allegro didn’t immediately respond to a request for comment.

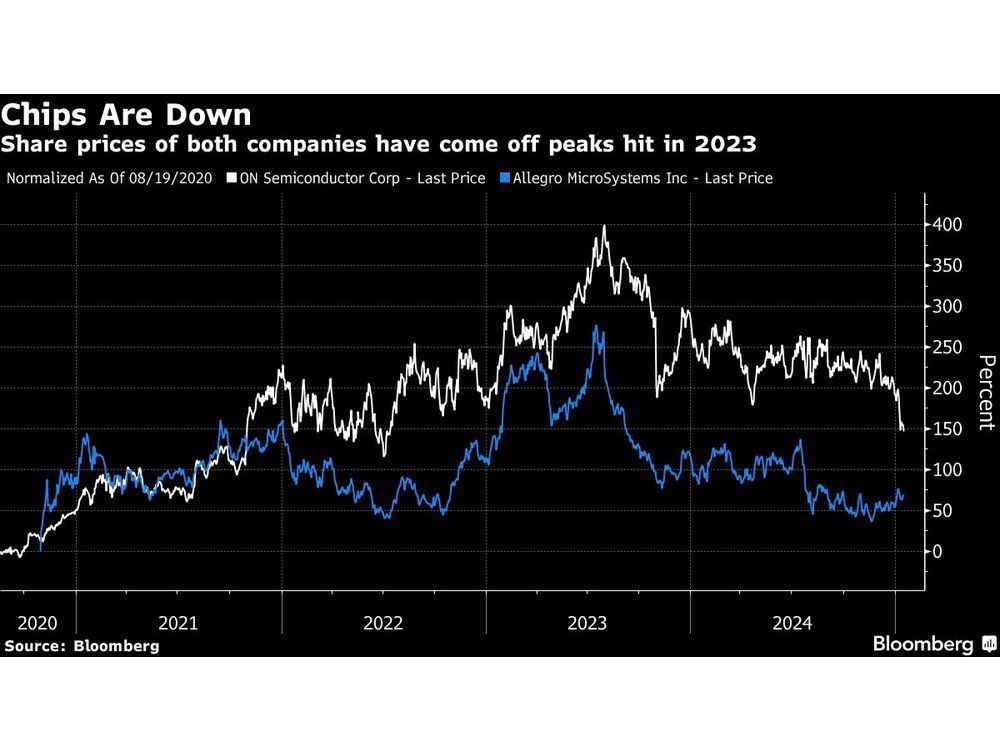

Allegro’s shares have dropped about 31% over the year, giving the Manchester, New Hampshire-based company a market value of about $4.1 billion. ON Semi has fallen 42% in that time and is valued at $19.8 billion.

Last week, Allegro announced it was replacing its chief executive officer of almost three years, Vineet Nargolwala, with longtime executive Mike Doogue.

Allegro’s biggest shareholder is Japan’s Sanken Electric Co., with a stake of about 32%, according to data compiled by Bloomberg.

Allegro develops advanced semiconductors, describing itself as a leader in power and sensing solutions for motion control and energy-efficient systems. The products are used in car engines and safety systems, as well as data centers and factories. On Semi also develops power and sensing technologies used in automotive, industrial and cloud-computing sectors.

Analysts have warned that automotive chipmakers could face sales pressure as the electric-vehicle market in the US slows under Donald Trump’s administration.

—With assistance from Ian King.

Share this article in your social network