Article content

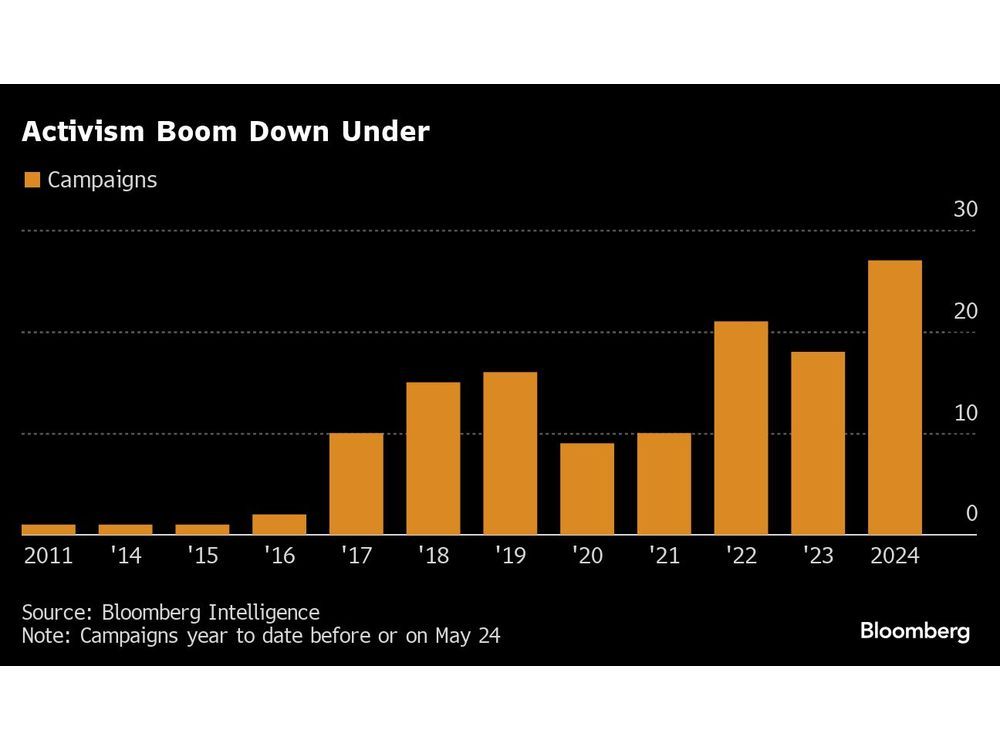

(Bloomberg) — Australian investors are more engaged in activism than at any time in more than a decade as active campaigns surge and companies bow to pressure from agitating shareholders.

This year is the biggest for activist campaign starts on record, according to data compiled by Bloomberg Intelligence that goes back to 2011. So far in 2024, there have been 27 campaigns launched on Sydney-listed companies, more than double the average over the past decade for the same period.

Article content

Lendlease Group is the latest Australian company to concede to investor demands after the real estate firm said Monday it will sell international assets. Activist shareholders including Tanarra Capital and Allan Gray have been pushing the firm to overhaul its global ambitions and the move will leave Lendlease focused on Australia.

Five of this year’s campaigns are targeting companies worth over $1 billion, including pursuits against oil and gas behemoth Woodside Energy Group Ltd. and agricultural firm GrainCorp Ltd.

Read More: Australia’s Lendlease Pivots on Overseas Property Strategy

As clashes between Australian firms and shareholders picked up in recent years, it’s brought new power brokers from billionaires to giant pension funds to the forefront.

In 2022, tech billionaire Mike Cannon-Brookes blocked a de-merger by AGL Energy Ltd., citing climate concerns. Gina Rinehart later scuttled Albemarle Corp.’s A$6.6 billion ($4.4 billion) takeover of lithium miner Liontown Resources Ltd. Meantime, AustralianSuper blocked a Brookfield Asset Management led multibillion-dollar acquisition of Origin Energy Ltd.

—With assistance from Jackie Edwards and Sarah Gill.

Share this article in your social network