Article content

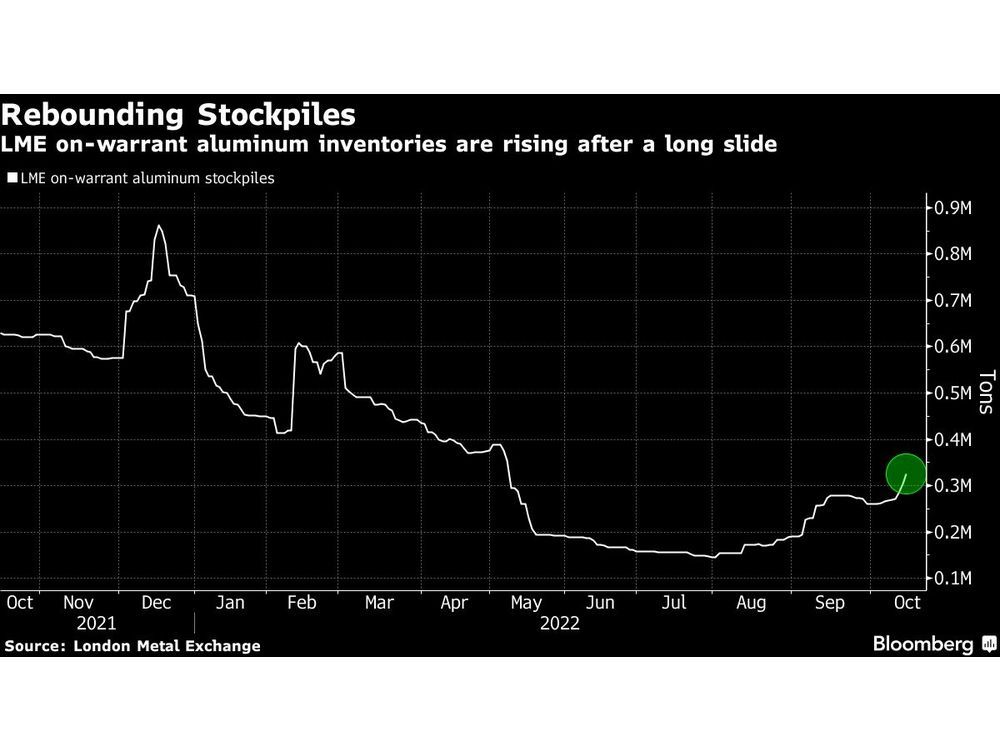

(Bloomberg) — Aluminum is continuing to pour into London Metal Exchange warehouses, lifting inventory levels at a time when demand is deteriorating and the market is on high alert for signs that unwanted Russian metal could end up on the bourse.

Article content

The LME is undertaking a three-week discussion process to consider banning new deliveries of Russian supplies, with feedback on the issue due by Oct. 28. Some buyers are seeking to avoid Russian metal and traders have been warning for weeks that large volumes could be dumped on the LME, particularly in the aluminum market, which could roil benchmark prices.

Article content

Aluminum has spent the year being rocked by supply shocks as Europe’s energy crisis forced many of the bloc’s smelters to curb production, leading to a draw-down in LME stockpiles to the lowest in decades. That’s not been enough to offset the hit to demand driven by a global slowdown in growth, causing prices to slide 43% from a record reached following Russia’s invasion of Ukraine.

Article content

Western sanctions on Russia introduced since the start of the invasion have largely avoided targeting metal supplies. But many buyers have shunned the country’s aluminum, raising concerns that producers could dump large quantities of metals on the LME.

United Co. Rusal International PJSC, Russia’s top producer, has said it has no plans to make large deliveries on to the exchange, and the LME has denied there have been large inflows of Russian metal. Still, that’s done little to calm nerves within the market.

“The last two days of inflows have been ingot metal,” said Alastair Munro, an analyst at Marex. “Our opinion is it might well be evidence of a drip of Russian metal onto the exchange.”

To be sure, most of the recent inflows have been into warehouses in Port Klang, Malaysia. Similar deliveries there in September were largely of Indian origin, according to people familiar with the matter.

On top of the LME’s potential ban, the US is now eyeing three possible measures on Russian aluminum after the missile strikes on Kyiv and other Ukrainian cities this week, Bloomberg reported on Wednesday. Sanctions on Rusal would be the most severe by freezing it out of Western markets. Import tariffs or a full ban on US imports would be less disruptive.

Aluminum futures on the LME declined by 1.7% to $2,318 a ton by 11:42 a.m. local time. It’s still on track for a 1% weekly gain. Other metals were mixed, with copper little changed, zinc rising 2% and lead edging lower.