Article content

(Bloomberg) —

(Bloomberg) —

(Bloomberg) —

Story continues below

Domestic UK stocks have had a rough year. And with recession looming and the pound plunging, it’s hard to see how things will get better anytime soon for a new prime minister on that front.

Britain’s mid-cap index — made up of companies that are heavily dependent on the local economy — is down 20% this year, on course for its biggest-ever annual underperformance against the exporter-heavy FTSE 100. The steep losses show investor pessimism has set in over the economy, with the Bank of England saying a recession may stretch into 2024.

“The FTSE 250 does clearly have its challenges,” Russ Mould, investment director at retail investing firm AJ Bell, said by email. “The UK economy is faced with the difficult combination of high inflation, slowing growth, rising interest rates, weak consumer confidence and substantial debt piles at the national and consumer level,” he added.

Story continues below

UK consumer price inflation breached double digits for the first time in 40 years in July, with Goldman Sachs Group Inc. subsequently warning that it could top 22% next year if natural gas prices remain elevated.

Against that backdrop, the domestic index just had its worst losing streak since the pandemic-driven rout in March 2020, while investors are turning more negative on UK stocks. A net 15% of global fund managers are underweight the country’s equities, up significantly from 4% in July, according to a Bank of America Corp. survey in August.

Underpinning the weakness is the UK’s crumbling currency, with the pound trading near the lowest since 1985. While that’s a boon to the exporter-heavy FTSE 100 — a surprising investor favorite this year due to its exposure to energy and banks — it means local companies face rising costs just when customers are dealing with a cost-of-living crisis.

Story continues below

It all adds up to a bleak economic picture for the UK’s new prime minister. Liz Truss, currently foreign secretary, is the front runner in the race, and many investors have criticized her proposed tax cuts as inflationary.

Cuts “will help hard-pressed consumers in some ways, but also risk stoking inflation in a manner that threatens to force the Bank of England’s hand when it comes to rate rises,” Chris Beauchamp, chief market analyst at spreadbetting firm IG Group, said in emailed comments. “Truss faces the mother of all policy headaches,” he said.

Homebuilders, Retail

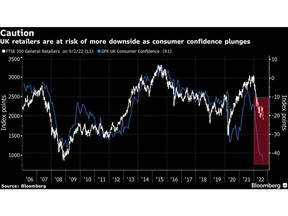

Among stock market sectors, investors are particularly cautious on UK homebuilders, utilities and retailers.

Companies like Persimmon Plc and Barratt Developments Plc have seen their market values cut in half this year as the Bank of England kicked off a program of rate hikes to combat inflation, while the FTSE 350 Retailers Index has sunk about 35%, reflecting Britons’ shrinking disposable incomes.

Story continues below

“Mortgage rates have surged this summer and are set to prompt a plunge in housing demand and lower prices from this autumn,” HSBC analyst John Fraser-Andrews wrote in a note on Friday as he downgraded seven homebuilders.

Utilities may also struggle, “particularly electricity and gas suppliers as they appear at the heart of the cost of living crisis,” said Tineke Frikkee, head of UK equity research at Waverton Investment Management.

Retailers, meanwhile, will be hoping the new prime minister announces support for households, freeing up cash for non-discretionary spending.

“Significant income tax, national insurance or VAT cuts may help support domestic consumption and provide some relief for retailers,” Ben Ritchie, head of UK and European Equities at Abrdn, said via email.

Story continues below