Article content

(Bloomberg) — European stocks gained as resources sectors received a boost after China said it would take steps to revive consumption.

Article content

The Stoxx Europe 600 Index rose 0.8% at the close in London. Oil rose for a second day, lifting the energy sector, after China said it is planning to boost people’s incomes and stabilize stock and real estate markets. Healthcare stocks also climbed, with Novo Nordisk A/S and Novartis AG making the biggest contribution to the wider regional benchmark gauge by index points.

Article content

Shipping stocks including AP Moller-Maersk A/S, Hapag-Lloyd AG rose as the US vowed strikes on the Yemen-based Houthi militants over Red Sea vessels attacks.

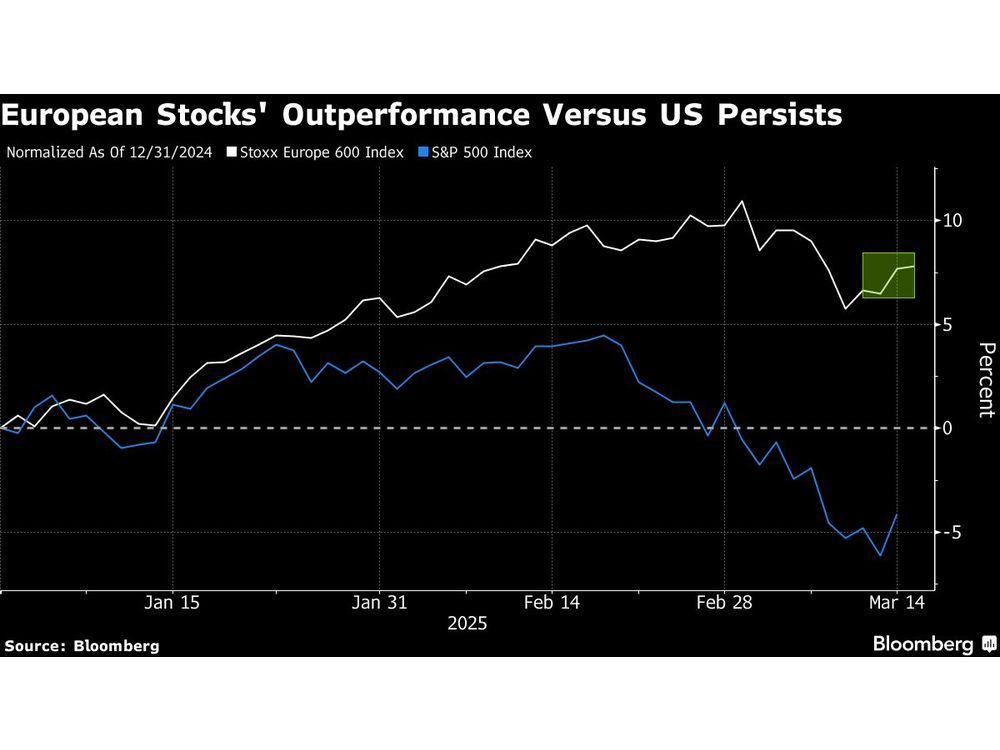

European stocks are holding up so far this year, rising around 8%, with Germany’s fiscal spending plans supporting the region’s outperformance. Investors’ optimism will hinge on the ability of the German parliament to push through the spending package on Tuesday.

“The confluence of China’s proactive economic measures and anticipated fiscal policy adjustments within the European Union has created a favorable environment for European equities,” said Patrick Armstrong, chief investment officer at Plurimi Wealth LLP.

European stocks held their gains Monday even as data showed that US retail sales rose by less than forecast in February, adding to concerns of a pullback in consumer spending.

Among other individual stocks, QinetiQ Group Plc dropped as much as 22%, the most on record, after the group downgraded growth expectations for this and next year.

For more on equity markets:

- Stakes Are High for Germany to Deliver on Spending: Taking Stock

- M&A Watch Europe: AstraZeneca, VW, ProSieben, U-Blox, Klarna

- US Stock Futures Fall

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

—With assistance from Michael Msika.

Share this article in your social network