Article content

(Bloomberg) — Singapore’s Temasek Holdings Pte. will continue to invest in major polluters even as it seeks to slash portfolio emissions, aiming to push sectors like aviation to decarbonize faster.

Five companies — including Singapore Airlines Ltd., energy producer Sembcorp Industries Ltd. and commodities trader Olam Group — account for about 80% of emissions from public and private equities in the investment firm’s S$389 billion ($288 billion) portfolio, Temasek said Tuesday, as it released a raft of climate data.

Article content

“The reality is that many of the areas are still relatively difficult to decarbonize,” said Kyung-Ah Park, Temasek International’s head of ESG investment management and managing director for sustainability.

If Temasek can help firms to improve climate performance and, in “the process of going from brown to green also capture the value creation that drives, then we will invest into those types of companies,” she said at a press briefing.

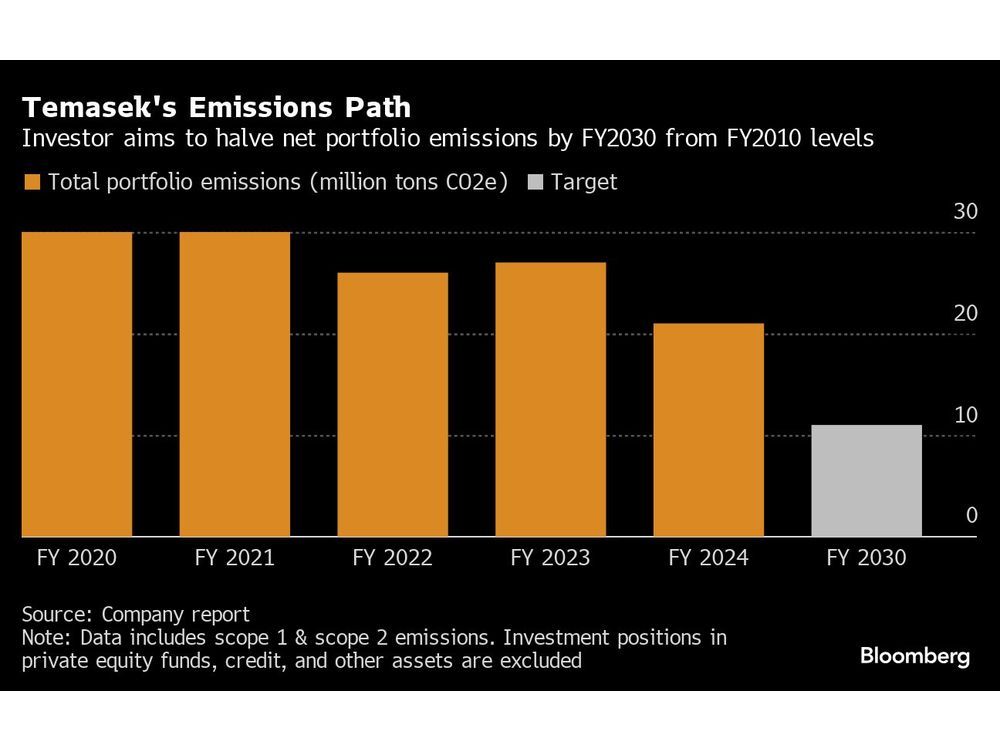

Temasek — which aims to cut net portfolio emissions to 11 million tons of carbon dioxide equivalent by the end of the decade, about half the latest figure — is currently working to encourage companies it holds to develop 2030 climate targets, or alternative near-term action.

Though portfolio emissions fell 22% in the year to March 31, the total is only 5% lower than in fiscal 2010 and the fund’s target remains “very ambitious,” Park said.

Temasek holds about S$44 billion in sustainability or climate transition-focused investments, including H2 Green Steel AB and electric scooter maker Ola Electric Mobility Ltd. The fund doesn’t have “an explicit exclusion” on sectors like oil, coal and gas, according to Park.

Article content

“There is a case to be investing also in high-emitting industries if you can actually transform them,” said Chief Investment Officer Rohit Sipahimalani.

Though many funds and banks have for years aimed to rid their portfolios of fossil-fuel assets and imposed specific exclusion policies, others — including a nonprofit backed by billionaire Chris Hohn — are reappraising the tactic as a method of delivering better climate outcomes.

Temasek has recently supported work to enable the early retirement of coal-fired power plants in the Philippines and elsewhere in Asia, and backed Singapore Airlines on a 20-month long trial to test adoption of sustainable aviation fuel.

The investor’s internal carbon price — a metric used to guide investment decisions — had been lifted to $65 a ton this year from $50 a ton set in 2022, with an expectation the rate will rise to $100 a ton by 2030, the company said.

—With assistance from David Ramli.

Share this article in your social network