AI-driven business finance comparison site, FundOnion, has announced plans to facilitate over £1 billion in funding to help up to 25,000 SMEs grow over the next four years.

The plans come as the small business finance platform continues to work to consolidate what is a historically fragmented market for small business loans.

It is estimated that the UK is suffering from a £22 billion funding gap for SMEs, stifling growth and limiting opportunities for a group of businesses that are vital to the UK economy, but poorly served by traditional funding routes. Combined with an application process that is time consuming and opaque, and a return to higher interest rates, there is a clear need for businesses to have clarity of the funding options available to them.

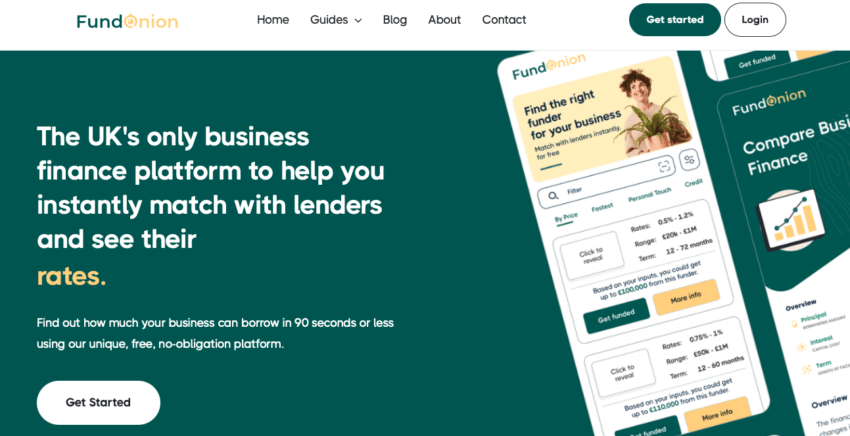

FundOnion’s platform enables businesses to quickly compare the cost of business loans from over 30 providers and secure funding in a faster and more transparent way. This world-first approach to business finance has led to an unheard-of pace of delivery, with FundOnion’s fastest loan being provided in just 19 minutes.

This funding has already been seismic for thousands of businesses in the UK. One family-owned business recently received a £500,000 growth finance loan through the FundOnion platform and was able to quadruple its revenue in just 12 months.

FundOnion CEO and Co-Founder James Robson, said: “The UK’s small business community has been chronically underfunded for over a decade as institutional lending has dried up, stifling growth, creativity and the economy. We’re flipping the script by providing the small business community with a platform that’s dedicated to fuelling their expansion and resilience. We’re also aware that our £1 billion goal is just the start of our ambitions to create the country’s best-known marketplace for business finance. Let’s be clear: we’re not here to play small.”

“While our core focus currently is business loans, we are adapting our technology and our capital partner infrastructure to offer a whole host of financial products to SMEs across trade finance, invoice finance, asset finance, and a whole universe of Asset Based Lending (ABL). We’re rewriting the playbook on how to provide capital to UK SMEs all while making a positive and meaningful difference to the UK economy.”