Article content

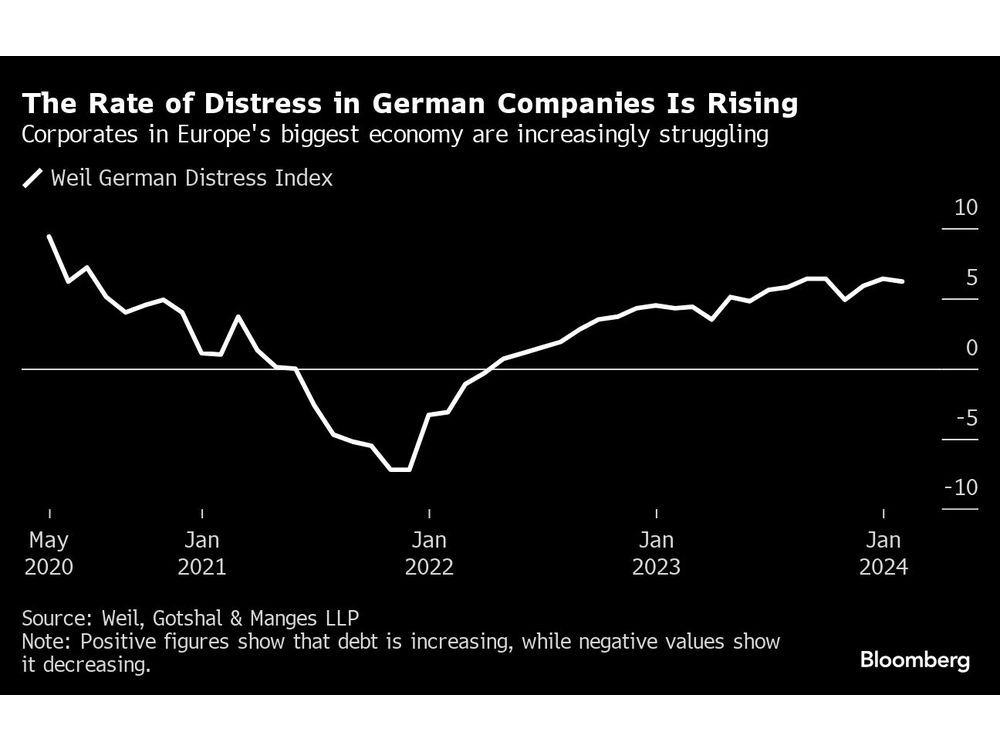

(Bloomberg) — Levels of stress at German companies hit the highest level in almost four years, as Europe’s biggest economy faces a sustained period of slower growth.

German corporate distress was the highest since 2020 at the start of this year, according to research published on Thursday. The study, by law firm Weil, Gotshal & Manges LLP, aggregates data from more than 3,750 listed European firms.

Article content

“German corporates continued to experience the highest levels of distress,” when compared to the UK, France, Spain and Italy, the Weil report said. “Investment hesitancy, alongside ongoing liquidity and profitability challenges, continue to impact firms amid a macroeconomic environment burdened by weaker economic growth.”

Germany is encountering a number of headwinds, including the cutoff of cheaper Russian energy supplies, weak Asian demand for exports, as well as higher interest rates. The country is in recession and its economy will hardly grow this year, according to a Bloomberg survey conducted last month. Any upturn is not expected until much later this year, the nation’s Economy Ministry warned in a report last month.

Among sectors in Europe, real estate remained the most distressed of all of the industries the Weil report examines, as higher interest rates and falling investment pose problems for landlords. Real estate distress has been a particular feature in Germany, where a number of high profile collapses and concerns over real estate lending have weighed on the sector. Investor appetite for German real estate deals remained low in the first quarter of this year, according to a report from broker Jones Lang Lasalle.

Article content

READ MORE: Germany’s Slow-Motion Property Crash Is a Looming Risk for Banks

Elsewhere in Europe, concerns over the valuation of offices have weighed heavily on the property sector. From Paris to London’s Canary Wharf, many workplaces have struggled with increasing debt burdens amid a switch to hybrid working practices.

“With the current macroeconomic indicators presenting a more nuanced picture than previous forecasts, we can expect capital-intensive and highly leveraged businesses to continue to feel pressure,” Andrew Wilkinson, senior European restructuring partner at Weil, said. “Those operating in the industrials, retail and real estate sectors are bearing the brunt of these pressures.”

Share this article in your social network