Article content

(Bloomberg) — Stocks in Asia are set for a muted open after US benchmarks wiped out gains in the final half hour of trading, with investors rebalancing their portfolios after a rally that’s already topped $4 trillion this year.

Futures for Sydney and Hong Kong pointed to declines in early Wednesday trading, while those for Tokyo indicated a slight gain. The S&P 500 fell for a third day, after a buying frenzy that’s seen it add almost 10% this quarter.

Article content

The US equity benchmark is on track to notch five straight months of gains. Now, traders are debating whether the road gets rougher for the rally to keep chugging along as stock valuations remain elevated relative to history.

“We still expect to see normal pullbacks along the way,” said Keith Lerner at Truist Advisory Services. “However, until the weight of the evidence shifts, we suggest investors stay with the primary market trend, which is up, and look to pullbacks as opportunities.”

In Tuesday’s session, the S&P 500 hovered near 5,200, with Nvidia halting a six-day rally. United Parcel Service Inc. slumped over 8% as investors saw its long-term sales target as hard to meet, while former President Donald Trump’s startup Trump Media & Technology Group Corp. climbed in its first session as a publicly traded company.

In Asia, Japan’s Nikkei 225 is one of few equity benchmarks able to match the pace of the US rally — advancing more than 20% this year and on track for one of its best quarters ever. Hong Kong has been unable to fully recover after plunging at the start of the year and is set for a slight decline, while Sydney is set to post a modest gain.

Article content

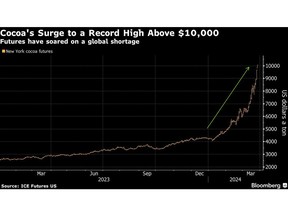

Treasuries rebounded from session lows on Tuesday after a $67 billion sale of five year-notes. Energy commodities and metals mostly declined, though gold edged higher, while cocoa broke above $10,000 a metric ton for the first time. The dollar was little changed.

As traders geared up for the Fed’s preferred inflation gauge on Friday — when markets will be closed — they parsed the latest economic readings. US consumer confidence held steady, durable goods orders climbed while home-price growth accelerated at the fastest rate since 2022.

For equities to warrant their gains in recent months, global central banks must ease monetary policy this year and companies have to deliver healthy earnings growth, according to JPMorgan Chase & Co.’s Marko Kolanovic.

“Stocks have moved higher in the first quarter in anticipation of the first rate cuts,” said Anthony Saglimbene at Ameriprise. “We have likely already entered a period where the Federal Reserve is now less likely to surprise the market from here on out.”

Overall, it’s likely that prices keep pushing up into late March given no evidence of technical deterioration, according to Mark Newton at Fundstrat Global Advisors.

Article content

“I continue to see the US stock market as being attractive, technically speaking, and do not feel sufficient risk is there to warrant a selloff at this time,” Newton said.

A rally in the S&P 500 to 5,350-5,400 is definitely possible into mid-April — before a consolidation gets underway, he said.

Corporate Highlights:

- Apple Inc. iPhone shipments in China fell about 33% in February from a year earlier, according to official data, extending a slump in demand for the flagship device in its most important overseas market.

- Dell Technologies Inc. cut 13,000 employees over the last fiscal year, a steeper reduction in headcount than initially announced.

- McDonald’s Corp. will bring Krispy Kreme Inc.’s doughnuts to its restaurants across the US, marking the burger chain’s latest effort to attract diners for breakfast and all-day snacking.

- Short sellers are still betting billions of dollars that the rally in cryptocurrency-linked stocks fueled by a surge in Bitcoin will eventually end.

- Total short interest, or the amount that contrarian traders have pledged against crypto stocks, has increased to nearly $11 billion this year, according to a report from S3 Partners LLC on Monday. More than 80% of total short interest in the sector are bets against MicroStrategy Inc. and Coinbase Global Inc.

- Michael Novogratz’s Galaxy Digital Holdings Ltd. swung to a profit in the fourth quarter, bolstered by rising digital asset prices and increased trading volumes.

- Viking Therapeutics Inc. unveiled results from an early study of its experimental weight-loss pill, a product expected to compete with popular obesity shots.

- Rite Aid Corp. is nearing a deal with key bondholders and other creditor groups that will allow the pharmacy chain to avoid a liquidation, according to people with knowledge of the matter.

Article content

Key events this week:

- China industrial profits, Wednesday

- Bank of England issues financial policy committee minutes, Wednesday

- Eurozone economic confidence, consumer confidence, Wednesday

- Fed Governor Christopher Waller speaks, Wednesday

- UK GDP revision, Thursday

- US University of Michigan consumer sentiment, initial jobless claims, GDP, Thursday

- Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

- US personal income and spending, PCE deflator, Friday

- Good Friday. Exchanges closed in US and many other countries in observance of holiday. US federal government is open.

- San Francisco Fed President Mary Daly speaks, Friday

- Fed Chair Jerome Powell speaks, Friday

Some of the main moves in markets:

Stocks

- Hang Seng futures fell 0.6% as of 7:01 a.m. Tokyo time

- Nikkei 225 futures rose 0.1%

- S&P/ASX 200 futures fell 0.2%

- The S&P 500 fell 0.3%

- The Nasdaq 100 fell 0.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The Australian dollar was little changed at $0.6534

Cryptocurrencies

- Bitcoin rose 0.4% to $70,110.51

- Ether rose 0.5% to $3,594.1

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.23%

- Australia’s 10-year yield was little changed at 4.03%

Commodities

- Spot gold rose 0.3% on Tuesday to $2,178.80 an ounce

This story was produced with the assistance of Bloomberg Automation.

Share this article in your social network

Comments