Article content

Wall Street traders sent stocks to fresh all-time highs as the United States Federal Reserve signalled it’s on track to cut interest rates for the first time since the onset of the pandemic.

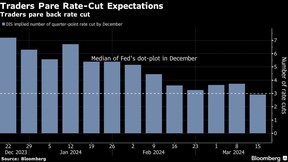

In a historic move, the S&P 500 topped 5,200 on speculation that the end of the most-aggressive Fed hiking cycle in a generation will keep fuelling corporate profits. Gains in equities were almost broad-based, with areas that have been lagging this year — like small caps — rallying. Short-term Treasuries outperformed, with traders now seeing higher odds of a first Fed move in June.

Article content

Policymakers kept their outlook for three cuts in 2024 and moved toward slowing the pace of reducing their bond holdings, suggesting they aren’t alarmed by a recent uptick in inflation. While Jerome Powell continued to highlight officials would like to see more evidence that prices are coming down, he also said it will be appropriate to start easing “at some point this year.”

Article content

“The sum total of this ‘no news is good news’ press conference is that markets continue to have a green light to run higher,” said Chris Zaccarelli at Independent Advisor Alliance. “This Fed isn’t going to stand in the way of the bull market.”

The tech-heavy Nasdaq 100 rose 1.2 per cent, with Apple Inc. and Tesla Inc. pacing a rally in megacaps. In late hours, Micron Technology Inc. gave a strong revenue forecast, buoyed by demand for artificial-intelligence hardware. Two-year yields sank eight basis points to 4.6 per cent. The dollar fell.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.9 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 1.2 per cent

- The Dow Jones Industrial Average rose one per cent

- The MSCI World index rose 0.8 per cent

Article content

Currencies

- The Bloomberg Dollar Spot Index fell 0.4 per cent

- The euro rose 0.5 per cent to US$1.0919

- The British pound rose 0.5 per cent to US$1.2781

- The Japanese yen fell 0.3 per cent to 151.24 per dollar

Cryptocurrencies

- Bitcoin rose 3.1 per cent to US$65,714.01

- Ether rose 2.9 per cent to US$3,375.02

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.27 per cent

- Germany’s 10-year yield declined two basis points to 2.43 per cent

- Britain’s 10-year yield declined four basis points to 4.02 per cent

Recommended from Editorial

Commodities

- West Texas Intermediate crude fell 2.1 per cent to US$81.68 a barrel

- Spot gold rose 1.2 per cent to US$2,183.50 an ounce

Share this article in your social network