Article content

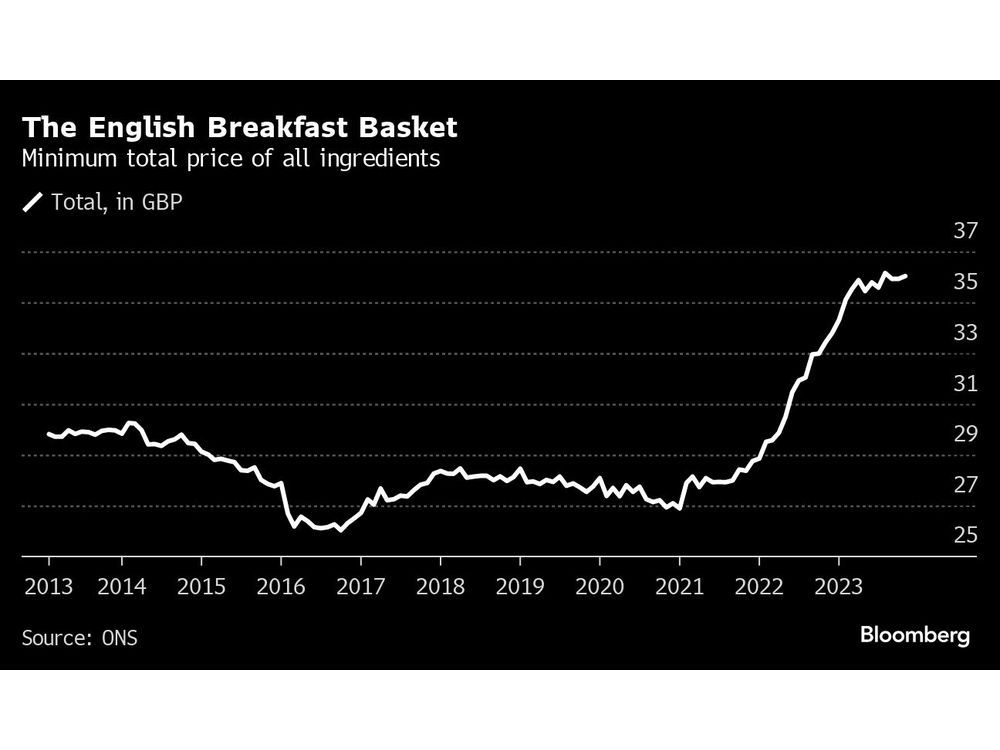

(Bloomberg) — A slowdown in UK inflation may be exciting economists and stoking bets that the Bank of England will cut interest rates, but the price of a traditional English breakfast is a reminder of the cost pressures still facing many families.

The average cost of ingredients for a “fry-up” is still more than 5% higher than a year earlier, according to Bloomberg’s monthly Breakfast Index. Prices for most components of the traditional full-English rose in November compared with the year before, while only three — coffee, milk and butter — became cheaper.

Article content

The index uses product sizes provided by the Office for National Statistics to crunch the price of sausages, bacon, eggs, bread, butter, tomatoes, mushrooms, milk, tea and coffee. It gives a glimpse into the everyday impact of higher food costs on British consumers.

“The economic challenges are far from over,” said Kevin Bright, global leader of the consumer pricing practice at McKinsey & Co. ”Whilst price rises are easing and even declining in some areas, consumers are unlikely to see a like-for-like reduction in their wallets over the holidays.”

Prices for some staples “are still significantly higher than they were two years ago,” Bright said.

Sausage prices rose more than 14% from a year earlier, while bacon, eggs and tea bags all posted double-digit increases.

The total cost to buy all the breakfast ingredients rose slightly — by 11 pence — in November to £36.03 ($45.62), near the highest level on record, as it takes time for lower food inflation to impact shopping baskets.

“For most Brits their budgets are still feeling significant strain,” said Danni Hewson, head of financial analysis at investment platform AJ Bell. “It remains vital no one forgets that whilst inflation is falling it doesn’t mean prices are falling.”

Article content

The latest figures from the ONS’s consumer prices index on Wednesday showed the pace of overall food inflation slowed to 9.2% in November from 10.1% a month earlier, the first time since June 2022 that the level has been in single digits. The UK’s broader inflation figure tumbled to 3.9% from 4.6% in October, a sharper slowdown than economists had expected.

The mood among consumers isn’t so upbeat heading into Christmas. UK retail sales were sluggish in November as Black Friday discounts failed to lure many shoppers struggling with the higher cost of living. Total sales grew 2.7%, compared with 4.2% growth a year earlier.

Retailers are also warning that 2024 could bring a tough trading environment, with higher operating costs likely to be passed on to customers. Businesses will have to grapple with a large increase to the national living wage from April along with higher business rates and new European Union border checks.

“There are many risks on the horizon for inflation in 2024,” said Helen Dickinson, chief executive of the British Retail Consortium. “To keep inflation falling, it is vital that the government considers the cumulative impact of their policies or the rising cost of doing business will undoubtedly filter back through to inflation.”

Read More: Pub and Retail Chiefs Warn UK Wage Hike to Hit Shoppers’ Pockets

The cost of ingredients also rose slightly from a month earlier in November as tea, sausages, coffee and milk all grew more expensive. Eggs and butter were among the items that fell in price as lower energy costs fed through to supermarket shelves.

This story was produced with the assistance of Bloomberg Automation.

—With assistance from Leonid Bershidsky.

Share this article in your social network