Article content

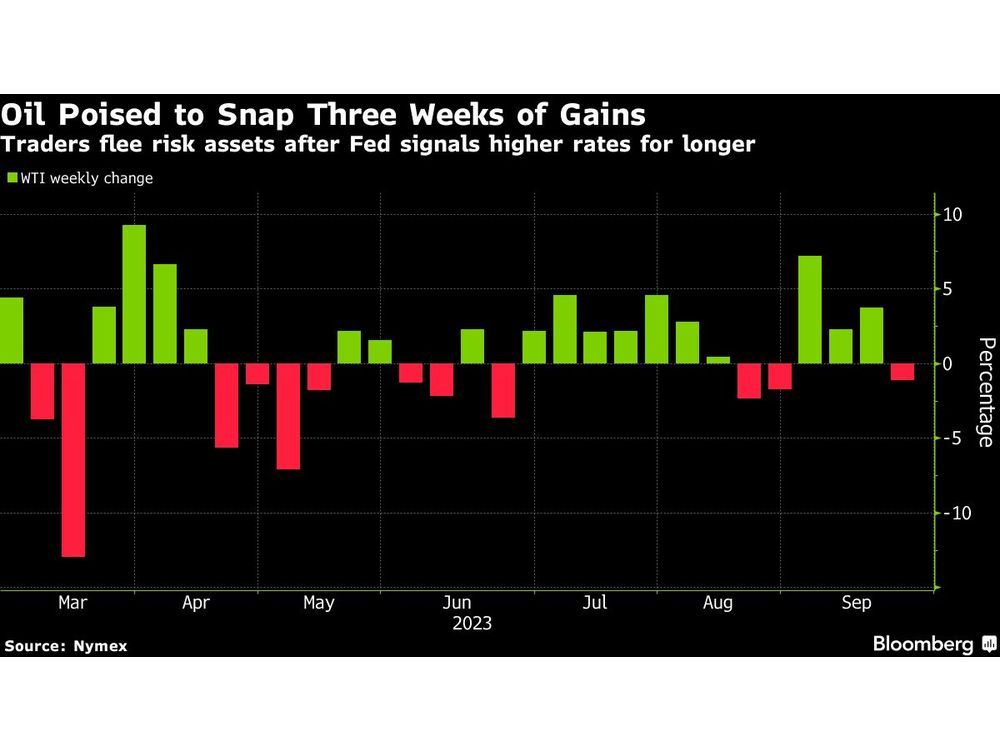

(Bloomberg) — Oil headed for its first weekly loss in four after the Federal Reserve flagged a further rise in US interest rates this year, damping appetite for risk assets and overshadowing physical tightness in the crude market.

West Texas Intermediate edged toward $90 a barrel on Friday, but was down about 1% for the week. The Fed signaled borrowing costs will likely stay higher-for-longer, aiding the dollar and dimming the allure of commodities. Technicals had also been indicating crude’s gains were overdone.

Article content

Still, there are plenty of signs of tightness in the physical market. Russia announced a temporary ban on diesel and gasoline exports on Thursday, lifting fuel prices. In addition, US crude stockpiles posted another decline, and oil’s backwardated timespreads point to strong competition for near-term supplies.

Crude has rallied strongly this quarter as Saudi Arabia and Russia extended their production curbs through the end of the year. The outlook for demand has also improved, with refiners in China, the world’s largest oil importer, ramping up processing to a record. The backdrop has prompted Chevron Corp. to Goldman Sachs Group Inc. to make the case for a return of $100 oil.

“Crude’s relentless rally of the past few weeks has run out of steam, but as yesterday’s choppiness illustrated, the consolidation phase may be rocky,” said Vandana Hari, founder of consultancy Vanda Insights. “Continued nervousness over supply fragility may prevent a sizeable or sustainable pullback.”

On Russia’s product shipment ban, both JPMorgan Chase & Co. and industry consultant FGE said they didn’t expect the prohibition to last for long. The curb will be in place for only a “couple of weeks, until harvest concludes in October,” JPMorgan analysts including Natasha Kaneva said in a note.

In the Middle East, meanwhile, US officials met with Iraqi Prime Minister Mohammed Shia Al-Sudani for talks, and emphasized the urgency of reopening an Iraq-Turkey crude pipeline as soon as possible, the White House said.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.