Article content

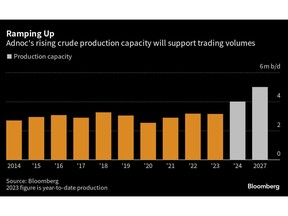

(Bloomberg) — The UAE’s biggest oil producer is pushing to build its fledgling trading operations into a multibillion-dollar business this decade by bolstering its presence in Europe and Africa, and expanding in other forms of energy.

In a bid to catch up with long-established rivals, Abu Dhabi National Oil Co. wants to take advantage of the hole left by Europe’s pivot from Russian fuels, according to people with knowledge of the company’s plans. It is pursuing term contracts for crude, refined fuels and liquefied natural gas and supplying those volumes to the region, they said, asking not to be named because the plans aren’t public.

Article content

Over the next year, Adnoc is targeting two to three long-term contracts to purchase LNG and as many separate supply deals with customers, according to one of the people. Expanding in LNG will be a primary focus after it hired three traders from Litasco, a unit of Russia’s Lukoil PJSC, last year.

The moves are part of Adnoc’s wider push to secure assets around the world, including a $12 billion pursuit of German chemical-maker Covestro AG and a $2 billion offer with BP Plc for an Israeli gas producer. Since Chief Executive Officer Sultan Al Jaber took over in 2016, the company has shed its previous conservative approach for an ambitious global presence.

“We’re executing a strategy where we would like to see an international expansion,” Musabbeh Al Kaabi, who oversees global growth at Adnoc, said in an interview in Singapore on Sept. 6. “Like integrated energy companies, we keep looking at opportunities to maximize value.”

Strategy Change

The ambition to step up trading in Europe and Africa marks a change in strategy for Adnoc, which has traditionally contracted out most of its oil and gas to Asia since it was founded over half a century ago. Set up in 2020, Adnoc Trading wants to emulate not just the billions of dollars of profits that independent merchant firms and integrated majors such as Shell Plc have made, but also the influence of the big traders.

Article content

Competition will be fierce. The incumbents have been operating for years and others from the Middle East have had a headstart. Saudi Aramco has expanded its trading unit and is moving ahead with plans to handle more fuels out of London. It also has refining ventures in Denmark and Poland that process its crude and provide products for sale. Kuwait has a refinery in Italy, and Oman, which started the region’s first state trading business, has global offices and contracts.

“The heightened volatility of markets in recent years — a phenomenon likely to become the new norm — provides more opportunity to profit from trading than in previous years,” said Vandana Hari, founder of Vanda Insights. “The challenge for these newcomers will be to grab market share from the more established players. It’s a high risk, high reward business.”

Adnoc last year considered buying all or part of trader Gunvor Group, which would’ve given it major heft in the industry and access to commodity merchant’s supply contracts. But a deal didn’t materialize and the UAE state company is now building out its trading business from within.

Article content

Geneva Office

Adnoc Trading aims to open its first European office in Geneva by the end of 2024, followed by a Houston outpost the year after, according to one of the people involved. The company already has a Singapore office dealing largely in chemicals trading.

The company is already trading Nigerian crude on a term basis, helped by financing arrangements that pay for the barrels. Its traders have also been experimenting with different crude grades mostly for the UAE’s biggest refinery at Ruwais on the Persian Gulf.

While Adnoc produces enough of its own crude, it has bought oil from Nigeria, Yemen and Angola, and from places as far as Norway and Australia. At least one Russian cargo has arrived at Ruwais and there have been several shipments of Kazakh crude.

In Africa and Central Asia Adnoc is looking to take advantage of religious and cultural ties, as well as government and financial influence to secure deals. In Kenya, Adnoc won part of a state fuel supply tender earlier this year. What Adnoc offers is political backing, cash for investment and an appetite for assets it can trade around.

“If maximizing value comes from trading, we will look at it,” Adnoc’s Al Kaabi said. “There’s a lot of potential levers to create more value from investing in international investments.”

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation