Article content

(Bloomberg) — Only a few weeks ago, the Bank of England’s upcoming decision over whether to pivot to pausing its rapid interest-rate rises was seen as on a knife edge. Now markets and economists are in little doubt.

Only a few weeks ago, the Bank of England’s upcoming decision over whether to pivot to pausing its rapid interest-rate rises was seen as on a knife edge. Now markets and economists are in little doubt.

(Bloomberg) — Only a few weeks ago, the Bank of England’s upcoming decision over whether to pivot to pausing its rapid interest-rate rises was seen as on a knife edge. Now markets and economists are in little doubt.

Story continues below

Investors view another rate increase at the May 11 meeting as a done deal, with more potentially on the way after a raft of resilient data this week that has wrong-footed forecasters.

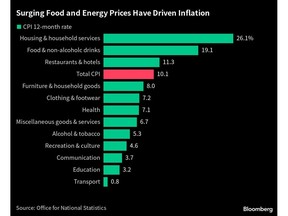

Inflation, wage growth, consumer confidence and the purchasing managers’ index all smashed economists’ expectations this week, signaling that a resilient economy will keep inflationary pressures on the boil.

The mostly sunnier readings suggest central bank policy makers led by Governor Andrew Bailey have more work to do to head off an upward spiral in prices. Investors have quickly factored in three more quarter-point rate hikes by September, which would push borrowing costs to a 15-year high of 5%.

“I think May is probably locked in now,” said Thomas Pugh, UK economist at RSM UK. “The data that we’ve had basically proves that certainly inflation and the labor market aren’t easing as quickly as they would like.”

Story continues below

Inflation unexpectedly remained in double digits in data for March. The crucial core and services readings — proxies for domestically generated pressures — were stickier than hoped.

Wage growth also sprung a surprise by showing little sign of cooling, holding steady at 6.6% in the three months through February. That was just below the highest level on record, excluding the pandemic months.

Private-sector pay excluding bonuses is still rising by almost 7% year-on-year. Crucially, a key wage metric watched by the BOE — annualized private wage growth — was firmly above 5%, a level economists say is not consistent with bringing inflation back to the 2% target.

Figures on Friday then showed that consumer confidence and the composite purchasing managers’ index both jumped to one-year highs in April. That points to an economy accelerating rather than succumbing to soaring living-costs pressures and higher interest rates.

Story continues below

Retail sales were the only downbeat figure of the week, with wet weather leaving the March figure weaker than expected.

However, even those figures confirmed that sales climbed overall in the first quarter. It was the first three-month on three-month increase since August 2021, when the economy was bouncing back from Covid-19 restrictions.

Together, the week’s data creates a headache for the BOE’s nine-member Monetary Policy Committee, which is led by Governor Bailey. Price and wage pressures are proving stickier than hoped, and demand in the economy is holding up. That suggests inflation will be more persistent.

“They’re going to raise probably but it’s not as clear cut as people are making out,” said Martin Beck, chief economic adviser to EY ITEM Club. “They’ve already raised it so much already, we’re still seeing that feed through to the economy.”

Story continues below

A quarter-point increase in Bank rate to 4.5% at the May meeting is now fully priced in by investors in what will be the 12th straight hike. Markets are also leaning towards another increase in June and then a third by September.

However, the narrative could turn quickly again. Between the BOE’s May and June meeting, the rate-setters will have two sets of inflation and wage data to chew over.

A large drop in inflation is widely expected in April because last year’s surge in energy prices will drop out of the annual figures.

“Given how volatile all of the data points are at the minute, there’s absolutely room for some surprises,” Pugh said. “You can argue it either way really.”

What Bloomberg Economics Says …

“The big surprise in pay gains and the stickiness in core inflation will dominate concerns for policy makers at the May meeting – paving the way for a 25-basis point hike and raising the risk that the hiking cycle extends into the summer.”

—Ana Andrade, Bloomberg Economics. Click for the REACT.

Read more:

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation