Article content

(Bloomberg) — European bonds rose sharply on the first day of trading in 2023, a sign traders are taking advantage of a recent selloff to lock in some of the highest yields in more than a decade before inflation starts to cool.

Article content

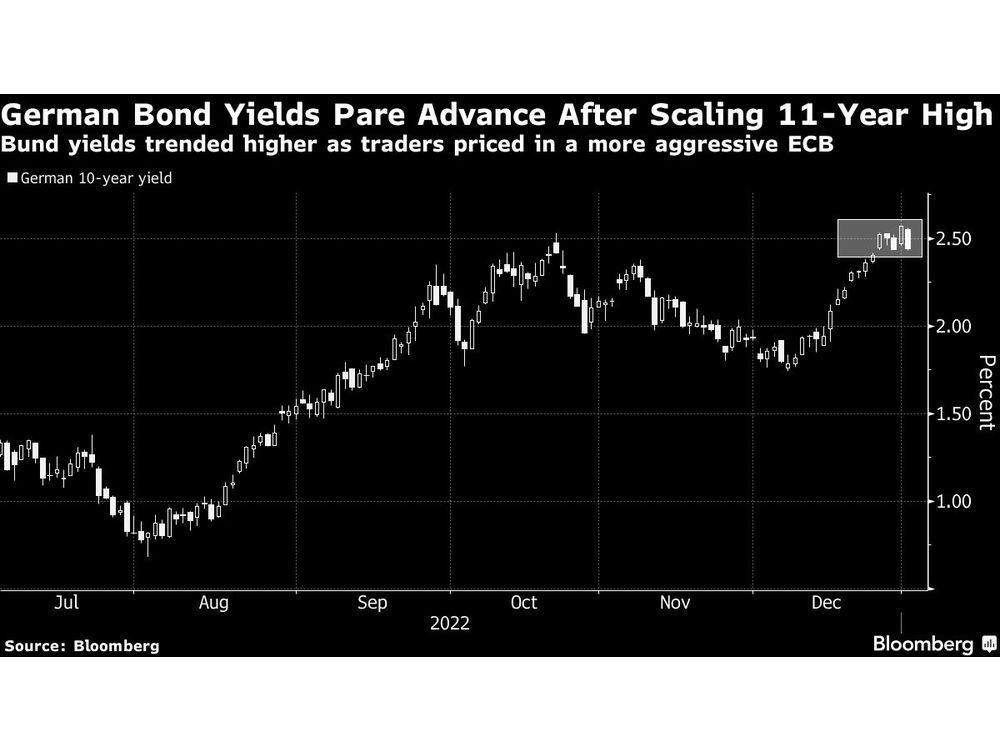

The rate on 10-year bunds fell as much as 14 basis points to 2.43%, easing off the highest level since 2011 touched last week. The yield on equivalent Italian securities plunged 16 basis points. The moves were likely accentuated by lower-than-usual trading volumes, with major markets still closed for holidays.

Article content

The battering meted out to fixed income markets by the aggressive pace of European Central Bank rate hikes may have gone too far for some, amid tentative signs that inflation is slowing. Data Friday will show annual consumer-price gains eased to 9.5% in December, from 10.1% the previous month, according to the median of 28 forecasts in a Bloomberg survey.

The repricing higher of German yields and a “probable drop” in eurozone inflation is “raising hopes for an upbeat start into the year,” Commerzbank AG strategists including Michael Leister wrote.

Traders also lowered bets on the ECB’s peak rate, wagering on 154 basis points of additional tightening by the middle of 2023, compared with 160 basis points at Friday’s close. The ECB has already raised rates by 250 basis points this year to 2%.

Policymakers are battling double-digit inflation spurred in part by an energy crisis caused by the impact of war in Ukraine. Governing Council member Joachim Nagel said additional measures are needed to curb rising expectations of future prices and return inflation to the 2% goal.