Article content

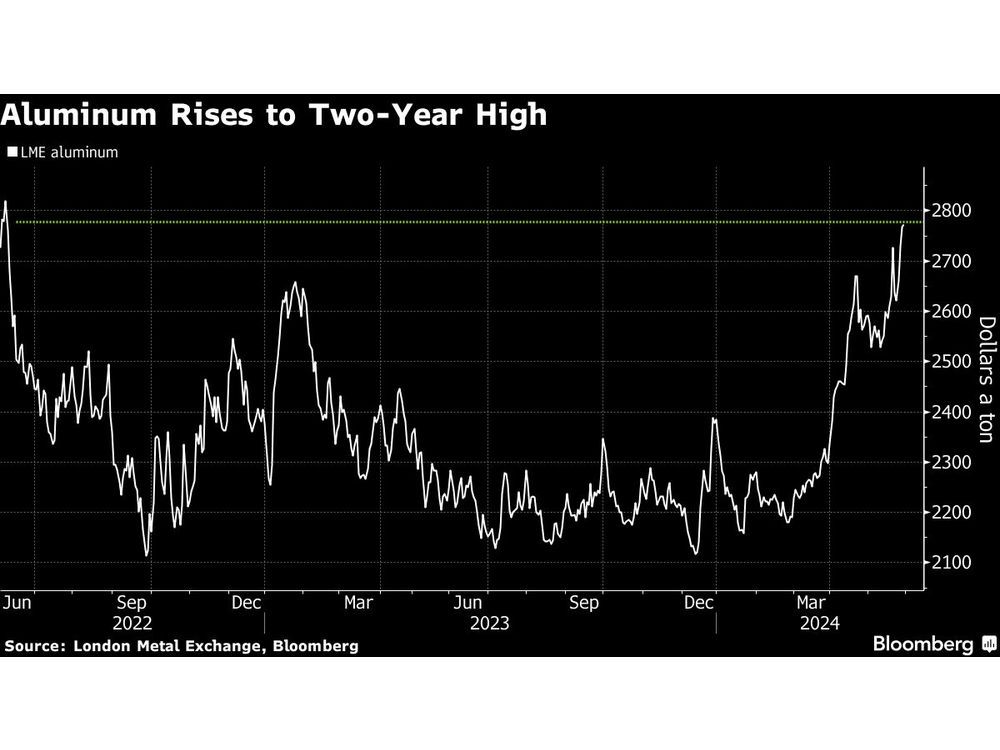

(Bloomberg) — Aluminum extended gains to a two-year high after China, the biggest producer, tightened capacity controls across an array of metals to meet emission-cutting goals.

The light metal used in everything from window frames to solar panels has climbed with other base metals this year as expected US monetary easing and China’s bid to step up rescue efforts for its beleaguered property sector bolstered demand. Prices are up almost 20% this quarter alone.

Article content

In a further boost for the bulls, China’s State Council pledged to strengthen capacity limits in industries from steel to alumina in a work plan for energy conservation and carbon reduction in 2024-25. The move to constrain additional supply comes at a time when the transition to greener energy is boosting demand for copper and aluminum.

The country will strictly control new capacity for copper smelters and alumina output, and take a reasonable approach in allocating fresh capacity for silicon, lithium and magnesium, the government said late Wednesday.

The government also reiterated strict implementation of the “aluminum swap scheme,” or the requirement for any new smelter to be matched by closure of an existing one. New capacity for aluminum, alumina, polysilicon and lithium batteries must meet advanced levels of energy efficiency, it added.

Aluminum rose as much as 1.1% to $2,799 a ton on the London Metal Exchange, the highest since June 2022, before trading at $2,777 by 10:58 a.m. in Shanghai. Other metals were lower, with copper down 1.1% as an historic squeeze in New York futures draws to a close.

Article content

Aluminum is a “good target” for funds exiting copper given healthy demand in China, which is supported by consumption in areas such as ultra-high voltage power transmission, said Kou Meiyun, an analyst with Shanghai Daohe Private Equity Fund Management Co. “Aluminum consumption is a bright spot among base metals.”

In steel, the country will continue with output controls this year, the government said, without elaboration. China has sought to cap crude-steel production below the previous year’s level in recent years, constraining demand for iron ore. Iron ore futures fell 1.9% to $116.70 a ton in Singapore.

Share this article in your social network