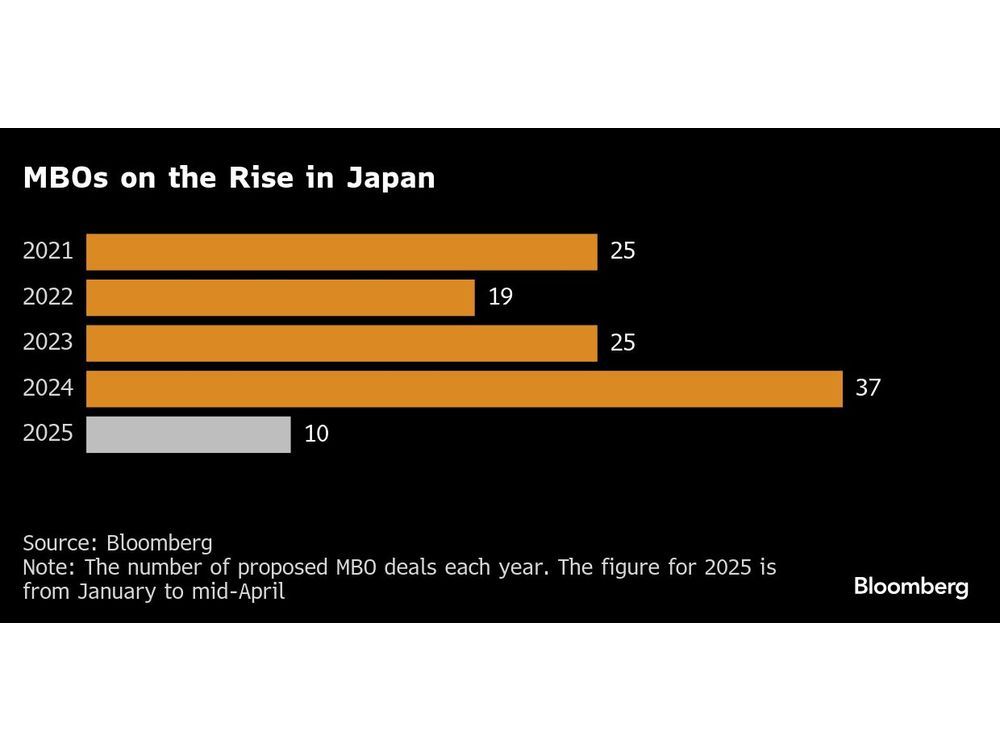

In many cases, pressure from investors, or just mere fear of it, works as a catalyst for MBOs. In March, Topcon Corp got a management buyout offer, which valued the optical equipment maker at about ¥358 billion. The deal came on the heels of calls from US activist investor ValueAct Capital for the company to sell some operations or go private. The number of firms listed in the three main sections of the Tokyo Stock Exchange has declined by 0.4% so far this year as delisting outnumbered new listings.