Article content

(Bloomberg) — Analysts who expect the Bank of Canada’s first interest rate cut in April are rare – but they believe economic data may soon prove there’s enough disinflationary pressure to spur policymakers into action.

Forecasters widely expect the central bank to hold its key rate steady at 5% next week and again on April 10. Seventeen economists in a recent Bloomberg survey unanimously said the first rate cut won’t happen until at least June.

Article content

But examining the reasons behind outlier calls can be worthwhile. Last year, Citigroup Inc.’s Veronica Clark was the first in a Bloomberg survey to predict that the Bank of Canada would resume hiking rates in June 2023 after the housing market surged. As more data emerged, other economists began to share her view, and she was ultimately proven right.

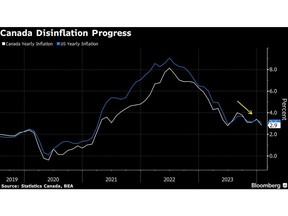

Whether or not that happens this time, the dovish analysts who see an April cut say recent data points to a slowing Canadian economy. Inflation decelerated to 2.9% in January and a preliminary retail estimate suggested a sharp pullback in consumer spending at the start of this year.

But the forecasters will need more evidence to strengthen their case, beginning with fourth-quarter GDP data due on Thursday. A soft GDP print, followed by cooling employment, wages and inflation in the coming weeks would clearly signal a weak economy and boost the case for an April cut.

“If the renewed progress is sustained in February’s data, we think the BoC should begin to ease its policy stance back toward neutral, with any delay risking a recession in Canada,” said Simon Harvey, head of FX analysis at Monex Europe. He said price data has already started to align with businesses’ inflation expectations and hiring decisions.

Article content

The central bank’s tone in next week’s policy statement, news conference and subsequent summary of deliberations will have bearing on whether an April cut is in play. Analysts will also closely watch the Federal Reserve decision on March 20.

The Bank of Canada’s policy rate typically tracks closely with the Fed’s. Cutting first risks weakening the loonie — already at its lowest level since December — which could boost inflation through higher import costs. While Fed officials have been wary of lowering rates too soon, the Bank of Canada could cut first if the data is convincing enough, said Rishi Mishra, an analyst at Futures First Canada Inc.

“That’s why, in fact, I think April odds should be a bit higher than where they are right now,” he said.

“However, if the Fed’s not cutting yet, it would imply that the US economy is motoring along nicely. Against that backdrop, for the BoC to cut rates — the bar is a bit higher. As in, the type of numbers that will be interpreted as convincing will have to be worse than when the Fed is cutting.”

Read More: Core Inflation ‘Buffet’ Muddies Timing of Bank of Canada’s Cuts

Article content

Stronger-than-expected jobs data earlier this month prompted some of Mishra and Harvey’s peers to push back their rate cut expectations from April to June. But one of those forecasters, Stephen Brown of Capital Economics, shifted his view somewhat after the inflation release.

“The encouraging January CPI data mean that the Bank of Canada’s April policy meeting is back in play for a potential interest rate cut, although it still seems more likely that the bank will wait until June – unless the economic and labor market data weaken markedly in the next seven weeks,” he said in a report to investors last week.

The release of gross domestic product data for the fourth-quarter on Thursday will be closely watched by economists who are still on the fence between an April and June cut, including Dominique Lapointe, director of macro strategy for Manulife Investment Management.

The median estimate in Bloomberg’s survey of economists is for 0.8% annualized growth. If there’s 0.5% growth or less, with disappointing consumption data, Lapointe would leave an April cut as his base case. A solid GDP number, on the other hand, could make it difficult to cut at that meeting.

“I would regret if I said June is the base case and we have zero GDP,” he said. If there’s a GDP miss and bad jobs numbers, “you are looking at an economy entering a small recession and you need to avoid this getting out of control. If you cut 25 basis points, you’re still really restrictive.”

—With assistance from Erik Hertzberg and Jay Zhao-Murray.

Share this article in your social network

Comments